Reasons to Refinance Your Home Mortgage in 2016

There are many benefits to refinancing and some of those reasons you will find listed below.

- A lot of folks tend to rack up credit card debt toward the end of each year and have some credit card debt to pay off in the next year. By refinancing your home you can put all of your credit card debt together and into the refinance. It is much better to pay off your credit card at say 5% instead of the interest you may be paying such as 18%. A good rule of thumb however if you do plan to use your refinance to get rid of your credit card debt is to cut the cards up and vow not to use them again. Perhaps you can keep one credit card that is to be used for emergencies only.

- Another great reason to refinance your home this coming year is to start saving towards retirement or even towards your child’s college education. Both of these are good causes and if refinancing can help you get to your goal of savings for these two a bit more quickly then why not take advantage of it.

- One of the biggest reasons folks tend to refinance their homes is to get a better interest rate. This is a very good reason to refinance because many times you can get a much lower monthly payment by having a lower interest rate and this may help you to more easily pay other bills that may have fallen behind.

- This last reason to refinance your home may sound a little out of place but if you happen to need a reliable vehicle and you haven’t been able to afford one, you can throw your car loan into the refinance as well. This is good if you have been trying to make your old worn out car last as long as possible but it has finally begun costing you more in repairs than the car is actually worth.

There are plenty other reasons to refinance your home in the coming year and even some reasons why you may not want to. Do your homework to see what is worth it to you and what is not when it comes to refinancing your home.

Courtesy of Montgomery AL Real Estate Expert Sandra Nickel.

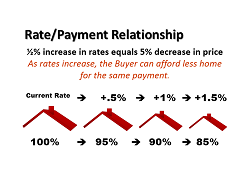

If you financed 100% of the cost of a $250,000 home at 4.5% interest for 30 years, the payment would be $1,266.71 per month. If the mortgage rate went up to 5%, the payment would be $1,342.05. If the home increased 5% in value, the $262,250 loan at the lower 4.5% rate would have payments of $1,330.05.

If you financed 100% of the cost of a $250,000 home at 4.5% interest for 30 years, the payment would be $1,266.71 per month. If the mortgage rate went up to 5%, the payment would be $1,342.05. If the home increased 5% in value, the $262,250 loan at the lower 4.5% rate would have payments of $1,330.05.

As a homeowner, you obviously pay for your mortgage but as an investor, your tenant does. Equity build-up is a significant benefit of mortgaged rental property. As the investor collects rent and pays expenses, the principal amount of the loan is reduced which increases the equity in the property. Over time, the tenant pays for the property to the benefit of the investor.

As a homeowner, you obviously pay for your mortgage but as an investor, your tenant does. Equity build-up is a significant benefit of mortgaged rental property. As the investor collects rent and pays expenses, the principal amount of the loan is reduced which increases the equity in the property. Over time, the tenant pays for the property to the benefit of the investor.

with mindful staging strategies, continued landscape maintenance, and seasonal awareness, your home could be just what they have been looking for.

with mindful staging strategies, continued landscape maintenance, and seasonal awareness, your home could be just what they have been looking for.

controversial one, however, with real estate and financial experts vociferously arguing about both the advantages and disadvantages of such a move.

controversial one, however, with real estate and financial experts vociferously arguing about both the advantages and disadvantages of such a move.