3 Ways to Get Your Home Ready For Winter

If you haven’t already noticed, it is getting colder with each passing day outside. If you want to stay cozy and warm inside your home this winter, you are going to have to do a few things to make sure it is possible. Typically folks don’t think about winterizing their home until it is already freezing cold outside. Hopefully you still have a few weeks  before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to get your home ready for winter.

before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to get your home ready for winter.

- Turn your heat on close to 80 degrees and leave it there until you hear the heat come on. If you hear the system come on and it seems to be making the home nice and toasty then you don’t have to worry about doing anything to your heat for the coming colder months. However, if you notice that the heat smells funny or that it is not getting the house as warm as you would like it, you may have to call in a professional to do a diagnostic test to see what the problem is and fix it for you.

- Get your fireplace ready for winter by making sure it is free of debris. Sometimes birds like to make their nests in chimneys and you don’t want to start a fire with a birds nest in the way. It’s also a good idea to make sure that the damper opens and closes as it should. This will help to insure that any fire you make in the fireplace brings the heat into your home instead of heating the outside. A good way to check the draft of your fireplace is to light a piece of paper and put in inside the fireplace. If the smoke rises then you should be good to go, if not then you probably have some sort of obstruction in the way and you need to clean it out properly before you make your first fire of the season.

- Check to make sure that there are no drafts around your doors and windows. You can purchase weather stripping at your local hardware store if you find that you do have some draftiness. You would be surprised at how much cold air can get in through even the tiniest of cracks in and around windows and doors in your home.

Hopefully these tips will get you started in the right direction for getting your home ready for winter.

Information courtesy of Montgomery AL Real Estate Expert Sandra Nickel.

After all, your monthly payment includes 1/12 the annual amount so there will be money available for them to be paid on time.

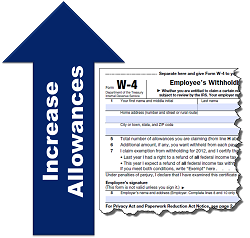

After all, your monthly payment includes 1/12 the annual amount so there will be money available for them to be paid on time. It is possible to adjust the deductions being withheld from the homeowner’s salary so they realize the benefit of the savings prior to filing their tax returns in the form of more money in their pay checks. Employees would talk to their employers about increasing their deductions stated on their W-4 form.

It is possible to adjust the deductions being withheld from the homeowner’s salary so they realize the benefit of the savings prior to filing their tax returns in the form of more money in their pay checks. Employees would talk to their employers about increasing their deductions stated on their W-4 form. Actually, no. Unfortunately, there are clever identity thieves waiting at that end of your relocation, also, and your

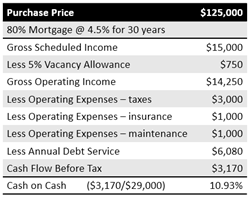

Actually, no. Unfortunately, there are clever identity thieves waiting at that end of your relocation, also, and your  Single family homes for rental purposes offer an excellent rate of return in an investment that most people understand better than other investments. The concept is simple: stay with predominantly owner-occupied homes in a slightly below average price range. In most areas, tenants are easy to find and they’ll usually stay two to three years or more.

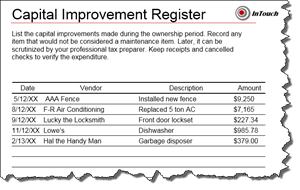

Single family homes for rental purposes offer an excellent rate of return in an investment that most people understand better than other investments. The concept is simple: stay with predominantly owner-occupied homes in a slightly below average price range. In most areas, tenants are easy to find and they’ll usually stay two to three years or more. Improvements must add value to your home, prolong its useful life or adapt it to new uses. Repairs are routine in nature to maintain the value and keep the property in an ordinary, operating condition.

Improvements must add value to your home, prolong its useful life or adapt it to new uses. Repairs are routine in nature to maintain the value and keep the property in an ordinary, operating condition. information behind that others can use---mail that is not rerouted to our new address, important papers that aren't shredded but left in the trash, or through hiring rogue movers. The

information behind that others can use---mail that is not rerouted to our new address, important papers that aren't shredded but left in the trash, or through hiring rogue movers. The  affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home?

affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home? Victims of Murphy’s Law can attest that their air conditioner goes out on the hottest day of the year or the water heater fails when you have out of town visitors.

Victims of Murphy’s Law can attest that their air conditioner goes out on the hottest day of the year or the water heater fails when you have out of town visitors. Years ago, real estate investors used to accept negative cash flow buoyed by tax incentives in hopes of making a big payday due to appreciation when they sold it. Today’s investors are focusing on tangible, current results like cash flow and equity build-up.

Years ago, real estate investors used to accept negative cash flow buoyed by tax incentives in hopes of making a big payday due to appreciation when they sold it. Today’s investors are focusing on tangible, current results like cash flow and equity build-up.