Originally, in 1913 with the Sixteenth Amendment, Income Tax allowed a deduction on any interest paid by a taxpayer. Prior to World War I, most interest was paid for business purposes and very little paid by individuals. Credit cards, revolving credit, student loans and home equity loans that would charge interest would not become popular for decades.

Originally, in 1913 with the Sixteenth Amendment, Income Tax allowed a deduction on any interest paid by a taxpayer. Prior to World War I, most interest was paid for business purposes and very little paid by individuals. Credit cards, revolving credit, student loans and home equity loans that would charge interest would not become popular for decades.

However, by the 1930’s, the Federal Housing Authority was created to help people to finance homes. Later, other quasi-governmental agencies like FNMA, FHLMC and GNMA were created to help facilitate mortgage lending.

Even though, Congress never intended to use this deduction to encourage homeownership, it has certainly benefited millions of people who couldn’t pay cash for their home. This deduction has made owning a home more affordable for tens of millions of people.

The Tax Reform Act of 1986 eliminated the deduction of interest on most personal debt with the exception of qualified mortgage interest debt. Two new terms were introduced to specify what was qualified.

Acquisition Debt is the amount of debt incurred, up to a maximum of $1,000,000, to buy, build or improve a principal residence or second home. It must be a recorded lien and the amount cannot be increased by refinancing. In other words, the acquisition debt is a dynamic amount that decreases as the loan amortizes.

Home Equity Debt is any amount up to a total of $100,000 over Acquisition Debt. It must also be a recorded lien against either the first or second home. It can be used for any purpose and is no longer restricted to medical or educational purposes.

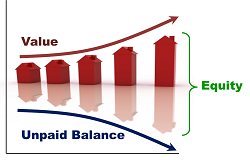

In the example below, a person borrowed money to buy a home and the entire first mortgage was acquisition debt. The unpaid balance was reduced by the payments made and the acquisition debt followed accordingly. At some point in the future, after the home had gone up in value considerably, the owner refinanced a much larger amount.

The existing acquisition debt was transferred into the new mortgage. Any borrowed funds that were used for capital improvements could be added to the existing acquisition basis. The interest on those funds would be deductible.

The owner/borrower could also deduct the interest on up to a maximum of $100,000 of home equity debt. If there was still debt above the acquisition and home equity debt, it would be classified as personal debt and the interest on it would not be deductible.

Lenders are not concerned if they are making a tax deductible mortgage on a home. They want to make sure there is sufficient equity in the property to secure the mortgage should it have to be foreclosed. A homeowner should consult with their tax professional if there is a question about deducting the interest on their mortgage.

Click Here to use a Refinancing Analysis.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

This dynamic leads to increasing a person’s net worth much faster than many other investments.

This dynamic leads to increasing a person’s net worth much faster than many other investments. enjoyment, do-it-yourself or contracted out, nearly 30 % of renovators maintain that they are hoping to increase the value of their home and recoup as much of the cost as they can.

enjoyment, do-it-yourself or contracted out, nearly 30 % of renovators maintain that they are hoping to increase the value of their home and recoup as much of the cost as they can. Originally, in 1913 with the Sixteenth Amendment, Income Tax allowed a deduction on any interest paid by a taxpayer. Prior to World War I, most interest was paid for business purposes and very little paid by individuals. Credit cards, revolving credit, student loans and home equity loans that would charge interest would not become popular for decades.

Originally, in 1913 with the Sixteenth Amendment, Income Tax allowed a deduction on any interest paid by a taxpayer. Prior to World War I, most interest was paid for business purposes and very little paid by individuals. Credit cards, revolving credit, student loans and home equity loans that would charge interest would not become popular for decades. Another important checkup that should be done on a regular basis and can be just as beneficial for your finances is an annual homeowner advisory. Why would you treat your investment in your home with less care than you treat your car or even your HVAC system?

Another important checkup that should be done on a regular basis and can be just as beneficial for your finances is an annual homeowner advisory. Why would you treat your investment in your home with less care than you treat your car or even your HVAC system? Paper:

Paper: controversial one, however, with real estate and financial experts vociferously arguing about both the advantages and disadvantages of such a move.

controversial one, however, with real estate and financial experts vociferously arguing about both the advantages and disadvantages of such a move. attention to curb appeal, cosmetic repairs, de-cluttering, and maintenance matters, while potential buyers are urged to focus on location, amenities, and structural stability. There are other, less publicized factors that impact a Montgomery AL home’s value, however, and they, too, should be included in a buyer’s or seller’s check list.

attention to curb appeal, cosmetic repairs, de-cluttering, and maintenance matters, while potential buyers are urged to focus on location, amenities, and structural stability. There are other, less publicized factors that impact a Montgomery AL home’s value, however, and they, too, should be included in a buyer’s or seller’s check list. these are certainly high-impact areas that could easily be made more efficient, there’s also much potential for going green in your home office. Check out these simple suggestions:

these are certainly high-impact areas that could easily be made more efficient, there’s also much potential for going green in your home office. Check out these simple suggestions: