According to Fannie Mae the top five reasons people buy a home:

- To have a better place to raise their children

- A place where their family can feel safe

- To have more space; Freedom to renovate to their own taste

- Being a homeowner is a better investment.

Does this hold true for you? Well, let’s take a look at these reasons to get a broader perspective…then you decide for yourself about being a homeowner.

Does this hold true for you? Well, let’s take a look at these reasons to get a broader perspective…then you decide for yourself about being a homeowner.

To have a better place to raise children and family can feel safe…

This can very subjective and involves a lot of factors. It boils down to community and personal preferences. What is the look and feel of a community where you could see yourself living? The school system and convenience to shopping are important. Local government services provided such as emergency services, hospitals, fire, police, utilities, etc. must be considered. Is there a neighborhood watch, public parks, a community center with activities for everyone in the family, etc.? Try making a list of all the things important to you and use it evaluate where you’re searching for real estate.

To have more space…

This is also somewhat subjective, but can be looked at analytically as well. Much depends on your lifestyle and the size of your family. There are large and small apartments, and large and small houses. Much has to do with how much space you would like to have versus how much you can afford. And this also really flows into the next topic…

Freedom to renovate for your own taste…

Whether you want to add on or simply renovate within existing walls, “freedom” is a huge factor in deciding to buy a house. Buying is not for everyone. Renting is a very good option for a lot of people. But the freedom to do as you please with your home is a powerful motivator. Here’s where lifestyle comes into play. It costs more to own a home than to rent. The money saved by renting can arguably be used to support a different lifestyle, which is also a form of freedom. Only you can decide.

Owning is a better investment…

There is no doubt that at the end of a renting cycle you walk away with no financial benefit except for the money you have saved in the process. How that savings compares with what you have when you sell a house you have owned is the question. And the answer is “It all depends.” Being a homeowner costs money. But, a lot of the money spent owning a home potentially can be recuperated. A homeowner is also building equity every month they make a mortgage payment. In that sense home ownership can be viewed as a huge savings fund.

If freedom is your primary key factor, buying real estate and becoming a homeowner is definitely to be considered!

Ready to own your own home? Start your search here!

Information courtesy of Montgomery AL Realtor Sandra Nickel, Hat Team!

Does this hold true for you?

Does this hold true for you?

Another way to say it is: don’t buy insurance when you can afford the loss. If you have a mortgage on your home, you must have insurance. It is probably prudent for most people to have property insurance but certain coverage might be avoided because you can afford the loss if you were to have an occurrence.

Another way to say it is: don’t buy insurance when you can afford the loss. If you have a mortgage on your home, you must have insurance. It is probably prudent for most people to have property insurance but certain coverage might be avoided because you can afford the loss if you were to have an occurrence. Does this hold true for you?

Does this hold true for you? Start early to research and plan

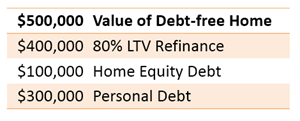

Start early to research and plan Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible.

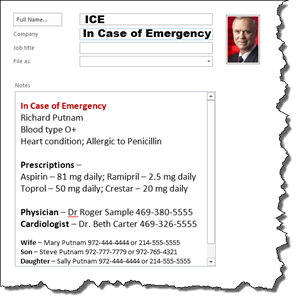

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible. The concept is simple. Make a contact record in your address book with the name “ICE”, which stands for In Case of Emergency. In the note section of the record, you would list your name, blood type and medical conditions along with prescriptions and physicians. You’d also list the people and their phone numbers that can be contacted in case of an emergency.

The concept is simple. Make a contact record in your address book with the name “ICE”, which stands for In Case of Emergency. In the note section of the record, you would list your name, blood type and medical conditions along with prescriptions and physicians. You’d also list the people and their phone numbers that can be contacted in case of an emergency. In some cases, you might only be able to name one or two of your neighbors who would step up to that level of service. Wouldn’t it be nice if more people on your street would be happy to make that offer?

In some cases, you might only be able to name one or two of your neighbors who would step up to that level of service. Wouldn’t it be nice if more people on your street would be happy to make that offer?