Owning a home is its own reward, but home ownership can also bring rewards at tax time. This year is especially beneficial for people who are in the market to buy a home, thanks to the $8,000 first-time buyer credit and the $6,500 tax credit for repeat buyers.

Current homeowners can benefit, as well. Tax credits are available for owners who improve the energy efficiency of their home, including replacing exterior windows, skylights and doors and installing efficient heating and air conditioning systems. Certain home improvements may qualify for as much as 30 percent of the project cost, up to $1,500.

Homeowners also enjoy a mortgage interest deduction; allowing them to deduct all the interest paid on up to $1 million in mortgage debt. If you bought a home in the past year, be sure to provide a copy of your HUD-1 statement to your tax preparer. The interest you paid at closing is not reflected in your year-end mortgage statement. Points and other closing costs may also be tax deductible.

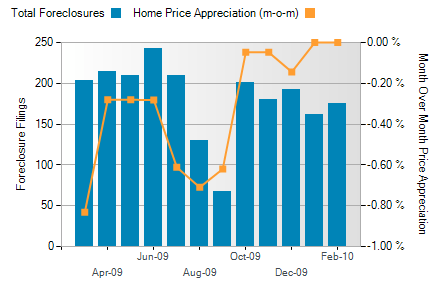

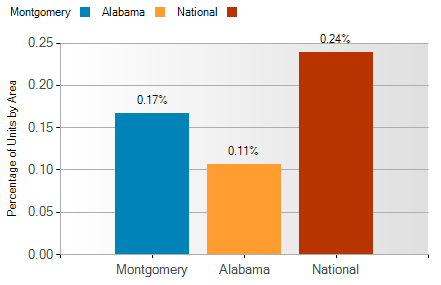

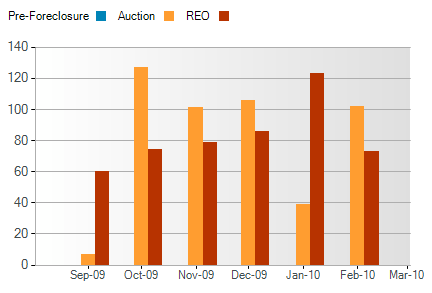

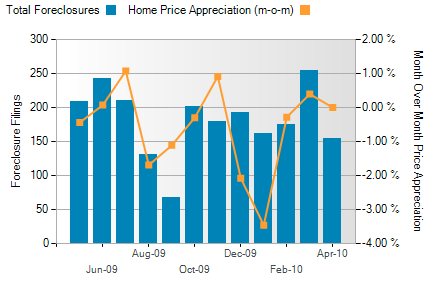

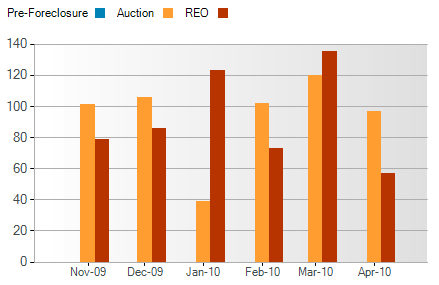

Many housing markets were affected by an extremely harsh weather in February. Take a look at what February looked like in our Montgomery AL real estate market:

Montgomery AL real estate sales statistics for February show pending sales have remained consistent in 2010 compared to February 2009. The average sales price decreased by 38% to $118,700 while sold listings were up by 32% from 2009. Market times were 17 days less than 2009.

|

Midtown

Montgomery

|

Pending

Sales

|

Sold

Listings

|

Average

Market Times

|

Average

Sales Price

|

|

Feb 2010

|

34

|

31

|

93

|

$118,700

|

|

Feb 2009

|

34

|

21

|

110

|

$190,729

|

To take advantage of these tax benefits and for the latest Montgomery AL real estate market conditions in your area, please call me at 800-HAT-LADY or visit HomesForSaleInMontgomeryAlabama.com.

Information is provided by the Montgomery Area Association of Realtors and is deemed accurate but not guaranteed.

ELIGIBILITY: First-time buyers and repeat buyers (those who have owned and lived in one residence for 5 consecutive years of the last 8).

ELIGIBILITY: First-time buyers and repeat buyers (those who have owned and lived in one residence for 5 consecutive years of the last 8).