Low listing prices, reasonable interest rates, and an abundant variety of homes to choose from are among a few of the reasons now is the perfect time for buyers to make a move in today’s real estate market. Current market trends and other factors have made conditions even more favorable for first-time homebuyers. Though becoming a homeowner comes with huge responsibilities and financial commitments, first-time home buyers should take advantage of the market over flowing with opportunities. The following tips will help ease the mind when considering the smart purchase of your first Montgomery home .

.

1. Become familiar with the new first-time homebuyer federal tax credit.

People who are considering the purchase of their first home, or have not been home owners for at least the past three years can gain great benefits from the first-time homebuyer tax credit. According to FederalHousingTaxCredit.com, qualified first-time home buyers purchasing a principal residence on or after January 1, 2009 and before May 1, 2010 will receive a tax credit of up to $8,000. Unlike past tax credits from 2008, the money received does not have to be repaid, unless the homebuyer sells the property with in three years.

2. Determine what is reasonably affordable.

Prior to beginning the hunt for the perfect home, it is important to find an affordable price range. Many factors such as money available for a down payment, eligibility for a loan, and monthly mortgage payments, all play a role in determining what the buyer can comfortably afford. Total monthly mortgage payments should be, on average, approximately 30 percent of one’s gross monthly income. Affordability or loan calculators found on the internet can give a good idea of what is affordable. Before seriously inquiring the purchase of your first Montgomery home it is important to have a consultation with a knowledgeable financial advisor.

3. Deciding where and what

Once an affordable price range is determined, it is time to decide where you want to live and what you are looking for in a home. Whether staying with in the same general area, or looking for a new location, it is crucial to do a fair amount of research on the area and its demographics. For example crime rates, school districts, shopping, medical facilities, and travel, are all important factors have to be considered since they could affect your everyday life. It is also essential to know what you are looking for in a home. Separate lists of essential needs and wants should be carefully thought out towards the beginning of the home search. The list of basic needs should include things such as minimum square footage, number of bedrooms and bathrooms, location, and price. The want list should be compiled of things that would be nice to have, such as pools, big yards, and gated communities.

4. Find a knowledgeable Real Estate professional

Finding and purchasing a home is a complicated, overwhelming experience, which should be nothing but exciting. Working with an experienced real estate agent can make the process run smoothly and be more successful. The chances of finding the perfect Montgomery home are significantly increased when put in to the hands of the right real estate professional.

Learn more about how we can help you purchase a Montgomery home by visiting HatTeam.com or give us a call for more personal service.

Tax Credit for First-Time Home buyers

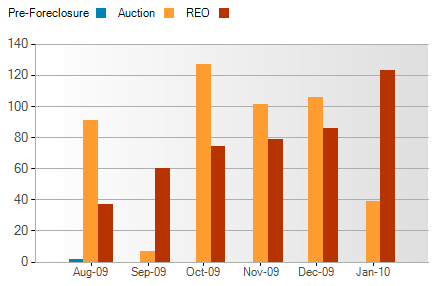

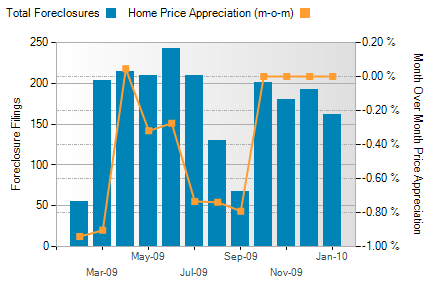

Tax Credit for First-Time Home buyers  This month's edition covers Montgomery real estate market activity and then we'll offer three top tips to make sure you get the most of today’s opportunity!

This month's edition covers Montgomery real estate market activity and then we'll offer three top tips to make sure you get the most of today’s opportunity!

A short sale is a real estate transaction option that banks will consider instead of foreclosure with specific guidelines. As a Certified Distressed Property Expert (CDPE) we are determined to provide essential knowledge to homeowners in Montgomery facing this unfortunate circumstance.

A short sale is a real estate transaction option that banks will consider instead of foreclosure with specific guidelines. As a Certified Distressed Property Expert (CDPE) we are determined to provide essential knowledge to homeowners in Montgomery facing this unfortunate circumstance.  .

.  Use Furnaces and Heaters Wisely

Use Furnaces and Heaters Wisely