Interior Painting Tips

Whether your desire for a new look inside your Montgomery home is because of the arrival of spring or because you hope to hasten the sale of your house, you may be considering repainting in the near future.

While painting can be a long, and sometimes unrewarding, task, professional painters and expert “do-it-yourself-ers” alike agree on ways to make the process less frustrating and more likely to produce a finished product you’ll be proud of. Basically, these tips center around organization, preparation, and patience.

1. GET ORGANIZED

Purchase all necessary supplies in advance. Include paint, brushes, rollers, and drop cloths on your list. Most pros advise using a canvas drop cloth because it absorbs drips and spills better than plastic, can be more easily contoured around corners, will lie flatter, and can be reused often. Consider buying a canvas runner (4’x15’) which can be more easily moved.

Purchase all necessary supplies in advance. Include paint, brushes, rollers, and drop cloths on your list. Most pros advise using a canvas drop cloth because it absorbs drips and spills better than plastic, can be more easily contoured around corners, will lie flatter, and can be reused often. Consider buying a canvas runner (4’x15’) which can be more easily moved.

Set up a work station in the middle of the room. This is the place to keep your paint, brushes and rollers, spackle, hammers and screwdrivers, cleaning rags, plastic sheets and bags, painter’s tape, paint can opener, etc. Think of everything you might possibly need while painting and gather them together in this one place.

Take everything down from your walls. Remove furniture completely or, if that’s not possible, move it all to the center of the room and cover with a cloth.

Remove all hardware from the surfaces to be painted in your Montgomery home. This includes switch plates, outlet covers, doorknobs, and light fixtures. Place the pieces from each one in a separate small plastic bag and label each one

2. TAKE TIME TO PREPARE

Patch all cracks and holes before painting.

Apply blue painter’s tape around doors and windows.

Prime the walls! This step is key to good results since primer blocks stains from bleeding through, improves adhesion of the main coat, reduces blisters, and generally assures one-coat coverage of the topcoat.

Tint the primer or use a pre-tinted primer. This is a especially helpful if you are using lighter colored paint to cover dark walls in your Montgomery home. Tinting can be done by mixing a small amount of your topcoat color with the primer. (Be sure you don’t mix latex and oil-based paints together!)

Handy hint: You can eliminate the strong smell of paint by adding a drop of vanilla extract to both the primer and the topcoat.

3. INVEST IN HELPFUL ACCESSORIES

Use a roller extension pole. A telescoping pole will do away with the need for a ladder and will allow you to reach those high places without much exertion.

Rather than using a roller tray (so easily spilled or jostled), look into getting a paint grid for use in a 5 gallon bucket. The grid fits into the bucket, removes excess paint from the roller, and eliminates the need for cleaning each time you stop painting.

4. PLAN FOR THE FUTURE

Remembering what colors you have used and when is important. Writing this information on the paint can is one way to job your memory, but a better way may be to write all the pertinent information on a piece of masking tape which you adhere to the back of a light switch.

Another tip: before you put the paint away, pour some into a small jar for touch-ups later on. Of course, you must label these jars, too.

So, organize, prepare, and be patient--and enjoy the fresh new look inside your Montgomery home!

What's your Montgomery home worth?

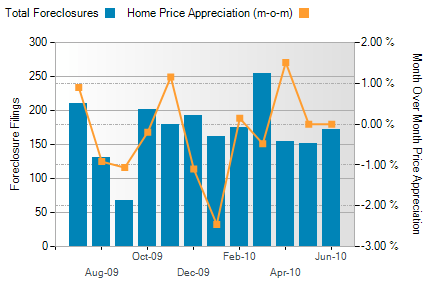

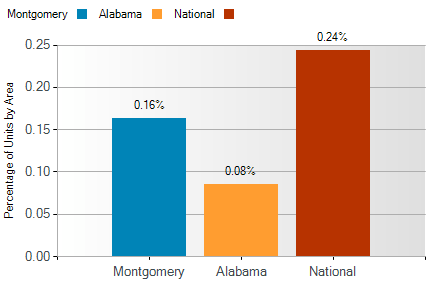

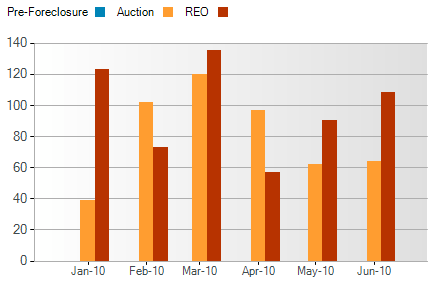

This month's edition covers Montgomery real estate market activity and then we'll discuss how to avoid surprises as mortgage underwriters are refreshing credit scores prior to closing.

This month's edition covers Montgomery real estate market activity and then we'll discuss how to avoid surprises as mortgage underwriters are refreshing credit scores prior to closing.

1. Insist on an in-home survey and estimate. Movers have to actually see what needs to be moved and be aware of items requiring special attention, such as pianos or valued art pieces. In addition, by meeting the mover’s representative in person, you can get a feel for the way customers are treated by the company. It is also important that you disclose at this time any details, such as elevator availability, street restrictions, etc., to avoid unpleasant surprises on moving day.

1. Insist on an in-home survey and estimate. Movers have to actually see what needs to be moved and be aware of items requiring special attention, such as pianos or valued art pieces. In addition, by meeting the mover’s representative in person, you can get a feel for the way customers are treated by the company. It is also important that you disclose at this time any details, such as elevator availability, street restrictions, etc., to avoid unpleasant surprises on moving day. Purchase all necessary supplies in advance. Include paint, brushes, rollers, and drop cloths on your list. Most pros advise using a canvas drop cloth because it absorbs drips and spills better than plastic, can be more easily contoured around corners, will lie flatter, and can be reused often. Consider buying a canvas runner (4’x15’) which can be more easily moved.

Purchase all necessary supplies in advance. Include paint, brushes, rollers, and drop cloths on your list. Most pros advise using a canvas drop cloth because it absorbs drips and spills better than plastic, can be more easily contoured around corners, will lie flatter, and can be reused often. Consider buying a canvas runner (4’x15’) which can be more easily moved.

Having a garage sale is out when

Having a garage sale is out when