Montgomery AL Home For Sale: 1468 Woodley Rd

Montgomery AL Home For Sale:

1468 Woodley Rd, Montgomery AL 36106

MLS# 303857

Completely Renovated Home Offering Lots Of Privacy!

Give up lots of yard without compromising interior space. This completely renovated home is tucked away in a cozy cul-de-sac and provides much privacy. Comfortable great room with fireplace opens to kitchen/breakfast area with travertine and granite. Spacious master bedroom and bath downstairs and two more guest bedrooms and a bath up. Covered rear patio makes a great outdoor living space, and the over-sized detached garage could serve many uses (workshop, home office space, man "cave", etc.) There is even a raised garden on the side for fresh herbs and veggies.

Search all Montgomery AL Real Estate And Homes For Sale.

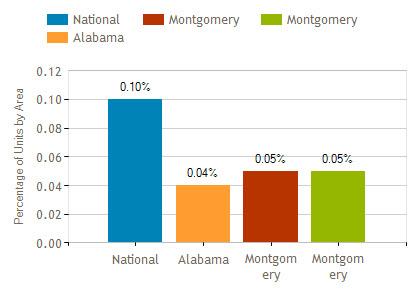

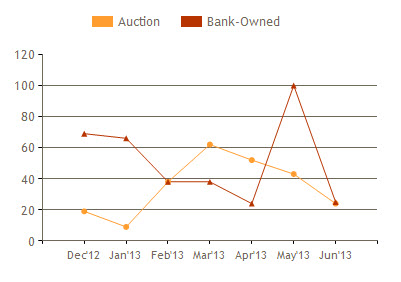

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

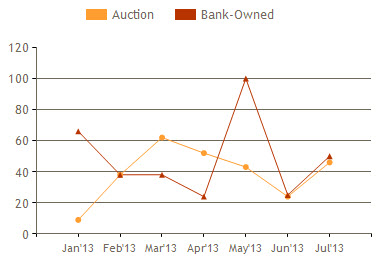

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

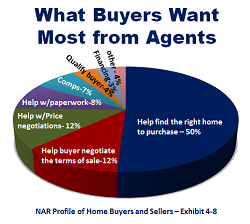

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise.

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise. It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

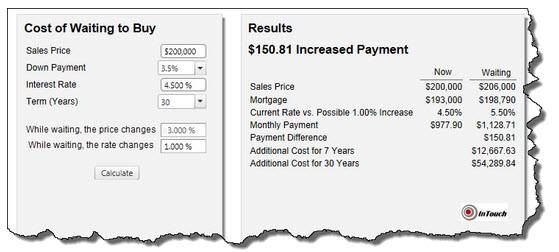

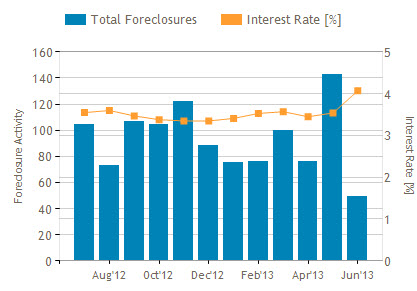

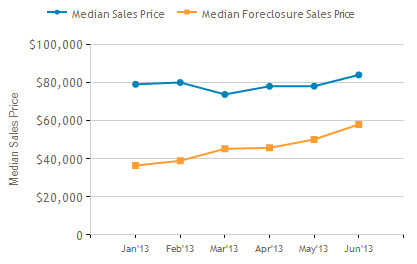

Home prices have gone up considerably in almost every market in the country in the past year and while inventories are beginning to grow, prices are expected to continue to rise. Mortgage rates jumped 1% from the beginning of May to now. They could easily reach 5% by the end of the year and continue to rise in 2014.

Home prices have gone up considerably in almost every market in the country in the past year and while inventories are beginning to grow, prices are expected to continue to rise. Mortgage rates jumped 1% from the beginning of May to now. They could easily reach 5% by the end of the year and continue to rise in 2014.