Montgomery AL Home For Sale: 1309 S McDonough St

Montgomery AL Home For Sale:

1309 S McDonough St, Montgomery AL 36104

MLS# 302446

Super Garden District Cottage!

Great 1920,s cottage in the heart of the Garden District. Features nice living-dining space with hardwood floors, heavy plaster walls, barrel ceiling, fireplace, and neat alcove off living room with built in book cases. Kitchen is very functional and has separate laundry attached. Huge pantry area off kitchen will accommodate all your food storage. Two good size bedrooms with lots of closet space and a third room off kitchen can be used as an office or whatever is needed. This home also features a walk down basement which can handle a lot of your storage needs. Large private backyard has access to rear alley if more parking space is desired. Give us or your favorite agent a call today to see this charming home and make it yours.

Search all Montgomery AL Real Estate And Homes For Sale.

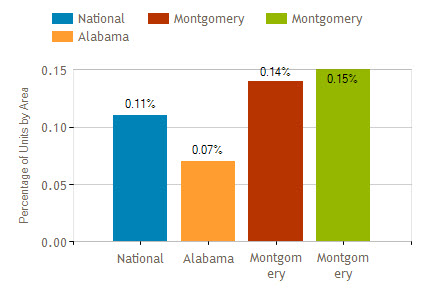

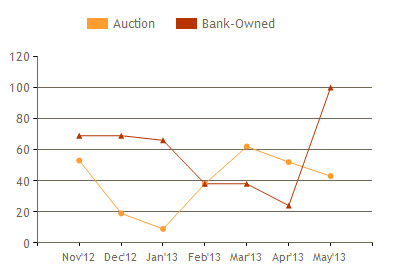

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

1. Remove the uncertainty that you may not be approved for a mortgage by having a pre-approval letter from your mortgage company.

1. Remove the uncertainty that you may not be approved for a mortgage by having a pre-approval letter from your mortgage company..jpg) air quality, job market prospects, available health care, specific amenities, and school ratings, not all fully comprehend the economic impact relocation may have on their lives.

air quality, job market prospects, available health care, specific amenities, and school ratings, not all fully comprehend the economic impact relocation may have on their lives.

controversial one, however, with real estate and financial experts vociferously arguing about both the advantages and disadvantages of such a move.

controversial one, however, with real estate and financial experts vociferously arguing about both the advantages and disadvantages of such a move.