1/2% Could Make a Big Difference

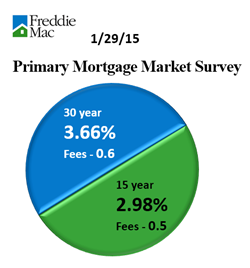

Over 50% of homebuyers don’t shop to find the best interest rate for their mortgage. While a buyer would rarely purchase the first home they look at, they will accept the rate and terms offered by only one lender.

While the borrower and the property affect the rate and terms that a lender may offer, it is not to be said that all lenders will offer the same terms and rates to the same buyer. Credit score, home location, home price and loan amount, down payment, loan term, interest rate type and loan type all affect the interest rate but different lenders can interpret this information differently.

While the borrower and the property affect the rate and terms that a lender may offer, it is not to be said that all lenders will offer the same terms and rates to the same buyer. Credit score, home location, home price and loan amount, down payment, loan term, interest rate type and loan type all affect the interest rate but different lenders can interpret this information differently.

Shopping around to compare rate and terms for a mortgage is a reasonable exercise considering that a half percent lesser interest rate could not only lower the payment but the cumulative interest that is paid while that loan is outstanding.

Some borrowers don’t shop the mortgage because they are concerned that having their credit checked multiple times could adversely affect their credit score. The credit bureaus take this into consideration when several requests are made by the same category of lender in a short period of time.

Check to see the difference 0.5% could make in the mortgage you’re considering by using the calculator provided by Consumer Financial Protection Bureau. Contact your real estate professional for a list of trusted mortgage professionals to consider.

Information courtesy of Montgomery AL Real Estate Expert Sandra Nickel, Sandra Nickel Hat Team.

Does this hold true for you?

Does this hold true for you?.jpg)

.jpg)

.jpg)

Sellers

Sellers