Montgomery AL Foreclosure Trends - March 2011

There were 1,420 Montgomery AL foreclosure homes for sale with 243 new foreclosures in March 2011. The average selling price of a Montgomery AL home was $136,478 and the average foreclosure selling price was $101,691 a $34,788 savings, according to RealtyTrac.com.

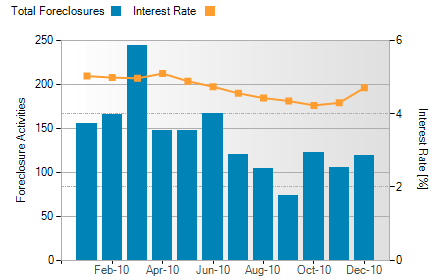

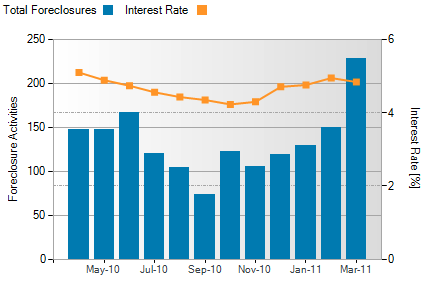

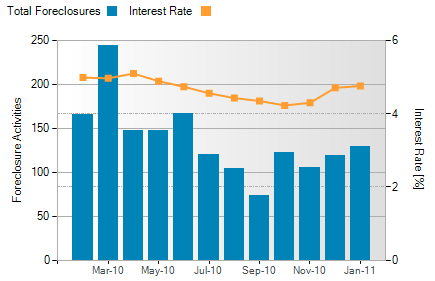

Montgomery AL Foreclosure Activity and 30 Year Interest Rate

Montgomery interest rates averaged 4.84% in March while the number of foreclosed homes increased from 150 in February to 228 in March.

Foreclosure activity is based on the total number of properties that receive foreclosure filings – default notice, foreclosure auction notice or bank repossession – each month. Interest rate is based on the average 30-year fixed rate from Freddie Mac Primary Mortgage Market Survey.

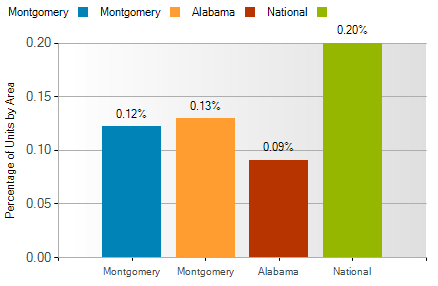

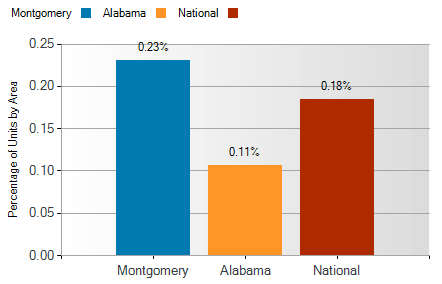

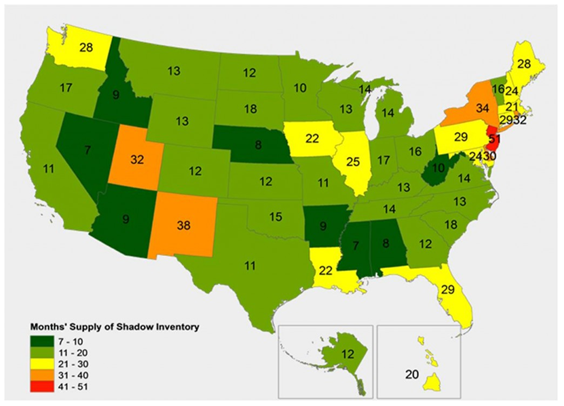

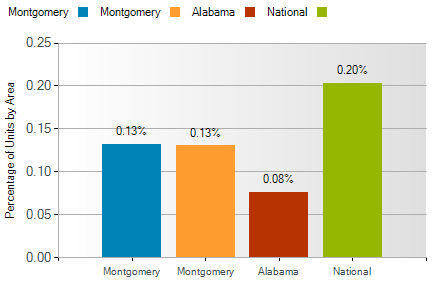

Montgomery AL Foreclosure Geographical Comparison

Montgomery foreclosure activity was 0.05% higher than national statistics. 0.12% higher than

Alabama statistics for the month of March.

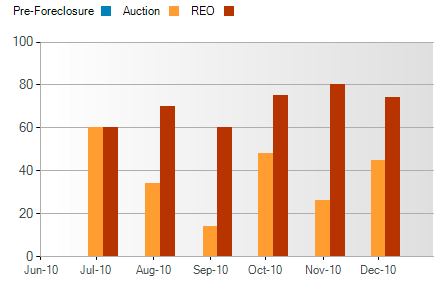

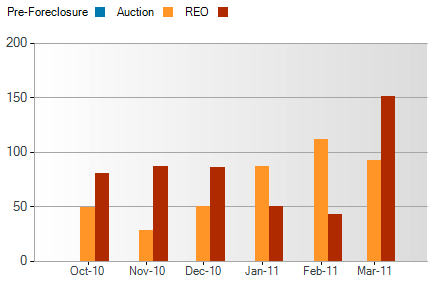

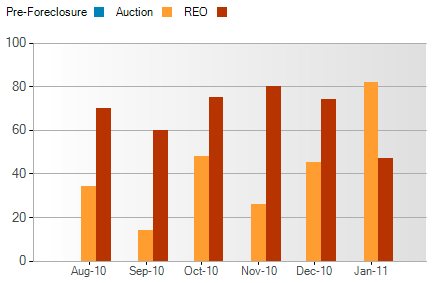

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties increased from 43 homes in February to 151 in March. The number of Auctions decreased from 112 to 92. There is a 6-month rising trend.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

, however, you should determine if he/she is qualified to handle your

, however, you should determine if he/she is qualified to handle your  Would-be buyers in the fourth quarter of the year are historically serious buyers who are very apt to buy during this season. Thus, the seller may have fewer ‘lookers’ but more motivated purchasers.

Would-be buyers in the fourth quarter of the year are historically serious buyers who are very apt to buy during this season. Thus, the seller may have fewer ‘lookers’ but more motivated purchasers.

You can make up the difference in cash.

You can make up the difference in cash.