Montgomery AL Real Estate: The Best Of Everything!

Montgomery AL Real Estate: The Best Of Everything!

357 Felder Ave, Montgomery AL 36104

MLS# 308076

The best of everything...classic style and updated features! This beautiful federal-style 3 story charmer has elegant formal spaces and comfortable living areas. The custom-designed kitchen features high-end appliances and a chef's stove! Off the kitchen and family room is a BIG covered patio overlooking a private back yard with in-ground swimming pool. Master suite on 2nd floor runs the entire width of the home and has cozy seating area with fireplace. Access the 3rd floor from a spiral staircase and find a wonderful split design AND full bath, making a great teen retreat, rec room, home theater, or tons of upscale storage. Detached 2 car garage affords additional storage and great off-street parking.

Search all Montgomery AL Real Estate And Homes For Sale.

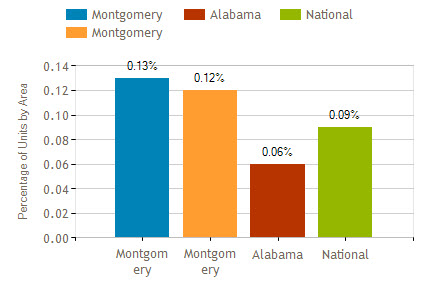

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

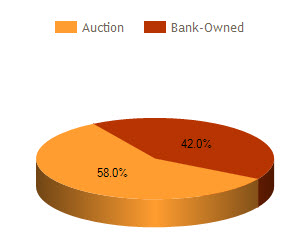

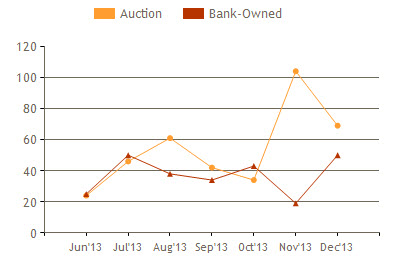

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

Usually, when you take money out of an individual retirement account before you reach age 59 1/2, the IRS considers these premature distributions. In addition to owing any tax that might be due on the money, you'll face a 10 percent penalty charge on the amount. This is not the case, however, when you use the money to buy your first investment property. (Note: Technically, you don't have to be purchasing your very first home or building. You qualify under the tax rules as long as you, or your spouse, didn't own a principal residence at any time during the previous two years.) You can use up to $10,000 in IRA funds toward this purchase. If you're married, and you and your spouse are both first-time buyers, you can each pull from retirement accounts, giving you $20,000 to use.

Usually, when you take money out of an individual retirement account before you reach age 59 1/2, the IRS considers these premature distributions. In addition to owing any tax that might be due on the money, you'll face a 10 percent penalty charge on the amount. This is not the case, however, when you use the money to buy your first investment property. (Note: Technically, you don't have to be purchasing your very first home or building. You qualify under the tax rules as long as you, or your spouse, didn't own a principal residence at any time during the previous two years.) You can use up to $10,000 in IRA funds toward this purchase. If you're married, and you and your spouse are both first-time buyers, you can each pull from retirement accounts, giving you $20,000 to use.