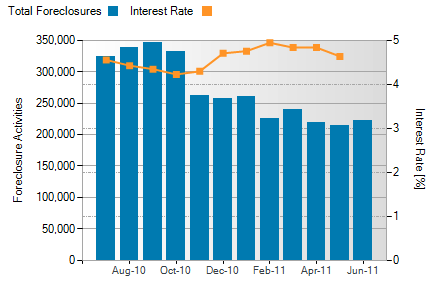

At least one fear was not realized amid last week’s stock market meltdown according to CNNMoney.com: the concern that mortgage rates would immediately shoot higher in response to Standard & Poor's downgrade of Fannie Mae and Freddie Mac, the government-sponsored entities that are the 800-pound gorillas of the mortgage market. In fact, the initial response to Fannie and Freddie getting cut to AA+ from AAA was precisely the opposite. Mortgage rates were poised to continue declining.

Mortgage rates are set off of the interest rates on U.S. Treasury notes and bonds. Even though Standard & Poor's pulled its AAA rating of the United States, investors still rushed into U.S. Treasury securities as a safe haven, believing more in the "full faith and credit of the United States" than in the opinion of Standard & Poor's credit analysts. As investors snapped up Treasury notes and bonds they pushed down interest rates on those securities, which move inversely to prices.

Analysts warn the drop in interest rates may not last. If investment flows were to move back into stocks and out of bonds, interest rates on Treasury securities, and consequently mortgages, would rise. "Over the long-term, if the U.S. has to pay more in interest rates, consumer rates will likely go up," said Greg McBride, senior financial analyst for Bankrate.com.

For now, lower mortgage rates may offer only limited benefits to American consumers. Banks' lending standards have been tough recently, and consumers need the wherewithal to qualify for loans. That appears increasingly difficult as the economy continues to sputter.

Now take a look at how the Midtown Montgomery real estate market performed in July.

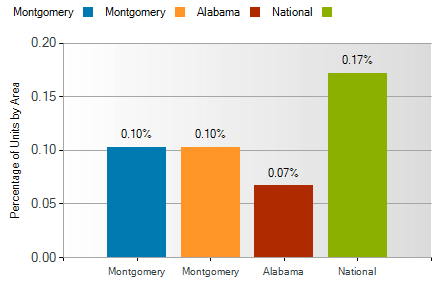

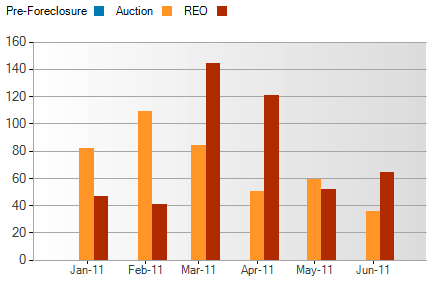

Midtown Montgomery real estate sales statistics for July show the average sales price decreased by 18% to $114,292 when compared to July 2010. The number of homes sold increased by 36% in July. The median sales prices decreased by 10%, and market times increased 10% or 15 days. The highest selling home price decreased by 36%, and the lowest selling home price decreased by 43%.

| Midtown Montgomery |

July 2011 |

July 2010 |

| Homes Sold |

25 |

16 |

| Average Selling Price |

$ 114,292 |

$ 138,794 |

| Median Selling Price |

$ 100,000 |

$ 110,950 |

| Days On The Market |

155 |

140 |

| Highest Selling Price |

$ 320,000 |

$ 500,000 |

| Lowest Selling Price |

$ 4,000 |

$ 7,000 |

For the latest Midtown Montgomery real estate market conditions in your area, please call me at 800-HAT-LADY or visit HomesForSaleInMontgomeryAlabama.com.

Information is provided by the Montgomery Area Association of Realtors and is deemed accurate but not guaranteed.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

You can reach Sandra by filling out the online contact form below or give her a call anytime.

TIME AND PLACE:

TIME AND PLACE: