Find the "Right" Agent Before the "Right" Home

It’s a common practice for buyers to make a list of what they want in a home during the search process and to explain it to their agent. However, maybe the first list they should make would have the skills they want their agent to have.

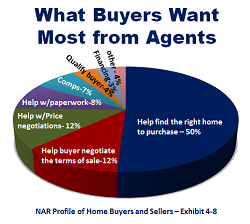

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise.

The Profile of Home Buyers and Sellers identifies what buyers want most from their agents and as you’d expect, help with finding the right home was ranked highest most often. While it is important, it may not be the most unique of the desired area of expertise.

Equally essential to the success of the transaction are the combination of help with price and terms negotiations and assistance with the paperwork, comparable sales, qualifying and financing.

To summarize the responses in the survey, Buyers want help from their agents with two things: to find the right home and to get it at the right price and terms. Some agents are actually better equipped with tools and acquired knowledge to assist buyers with financial advice and negotiations.

Since an owner’s cost of housing is dependent on the price paid for the home and financing, a real estate professional skilled in these specialized areas can be invaluable in finding the “right” home. An agent’s experience and connections to allied professionals and service providers is irreplaceable.

Ask the agent representing you to specifically list the tools and talent they have to address these areas.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

In the case of a couple having a joint mortgage, the death of one spouse will simply mean the other spouse becomes the sole mortgage-holder. As long as she can continue making the payments, the property will be unaffected. Federal law prohibits the lender from calling the entire mortgage due because one spouse has passed away.

In the case of a couple having a joint mortgage, the death of one spouse will simply mean the other spouse becomes the sole mortgage-holder. As long as she can continue making the payments, the property will be unaffected. Federal law prohibits the lender from calling the entire mortgage due because one spouse has passed away.  It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

It isn’t difficult to get into the real estate investing world. In fact, it’s rather easy. But it does require being smart and dedicated—and avoiding easy-to-make mistakes. These tips for a first time real estate investor should be beneficial in helping you become more knowledgeable and competent in sidestepping common pitfalls.

real estate, and sellers are far more likely to accept those fast-moving cash deals than one involving an FHA loan, the preference of many first time purchasers of

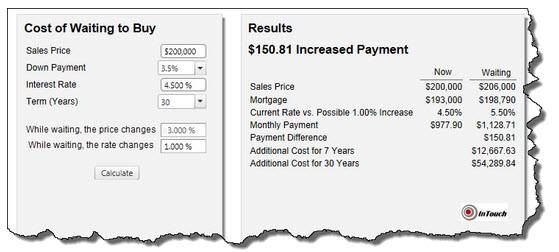

real estate, and sellers are far more likely to accept those fast-moving cash deals than one involving an FHA loan, the preference of many first time purchasers of  Home prices have gone up considerably in almost every market in the country in the past year and while inventories are beginning to grow, prices are expected to continue to rise. Mortgage rates jumped 1% from the beginning of May to now. They could easily reach 5% by the end of the year and continue to rise in 2014.

Home prices have gone up considerably in almost every market in the country in the past year and while inventories are beginning to grow, prices are expected to continue to rise. Mortgage rates jumped 1% from the beginning of May to now. They could easily reach 5% by the end of the year and continue to rise in 2014.