Montgomery AL Home For Sale: Living Is Easy!

Montgomery AL Home For Sale: Living Is Easy!

153 Sunset Ridge, Montgomery AL 36108

MLS# 307555

Popular layout makes for easy living in quiet Sunset Ridge. Open living room has vent less fireplace with large cut-out above for entertainment system. Separate but open dining area could double as a formal living space if desired. The large kitchen accommodates multiple cooks. Extra-large master bedroom will hold king-sized bed and lots of heavy furniture, and the master bath has garden tub and walk-in shower.

Search all Montgomery AL Real Estate And Homes For Sale.

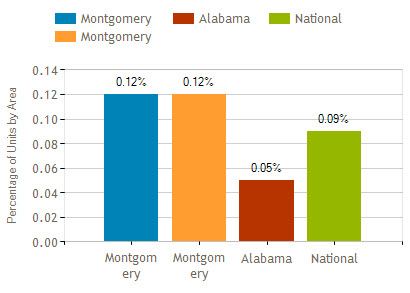

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

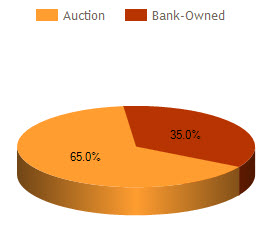

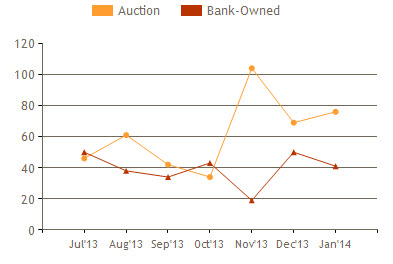

Interested in buying a bank-owned home? Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

.jpg)

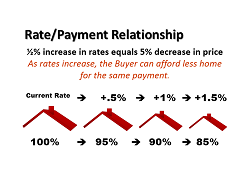

If you financed 100% of the cost of a $250,000 home at 4.5% interest for 30 years, the payment would be $1,266.71 per month. If the mortgage rate went up to 5%, the payment would be $1,342.05. If the home increased 5% in value, the $262,250 loan at the lower 4.5% rate would have payments of $1,330.05.

If you financed 100% of the cost of a $250,000 home at 4.5% interest for 30 years, the payment would be $1,266.71 per month. If the mortgage rate went up to 5%, the payment would be $1,342.05. If the home increased 5% in value, the $262,250 loan at the lower 4.5% rate would have payments of $1,330.05.