Montgomery AL Foreclosure Trends - October 2011

There were 882 Montgomery AL foreclosure homes for sale with 1 in every 796 housing units receiving a foreclosure filing in October 2011. The average selling price of a Montgomery AL home was $121,760 and the average foreclosure selling price was $52,416, a $69,344 savings, according to RealtyTrac.com.

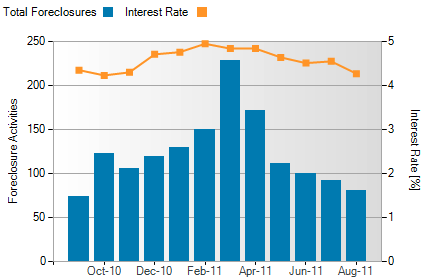

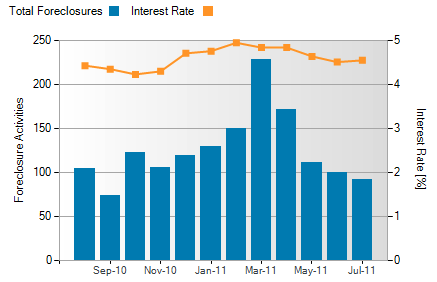

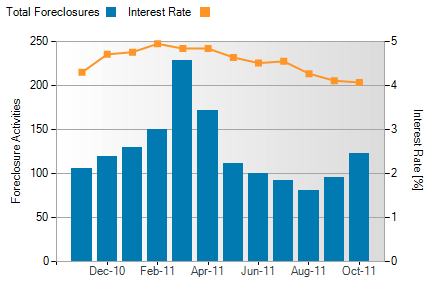

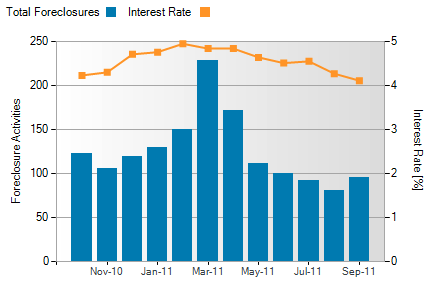

Montgomery AL Foreclosure Activity and 30 Year Interest Rate

Montgomery interest rates averaged 4.07% in October while the number of foreclosed homes increased from 95 in September to 122 in October.

Foreclosure activity is based on the total number of properties that receive foreclosure filings – default notice, foreclosure auction notice or bank repossession – each month. Interest rate is based on the average 30-year fixed rate from Freddie Mac Primary Mortgage Market Survey.

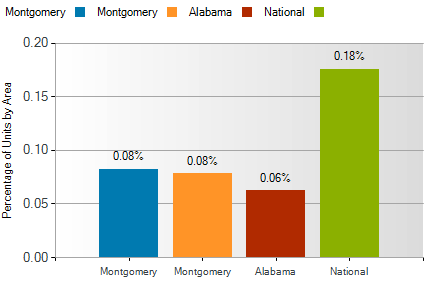

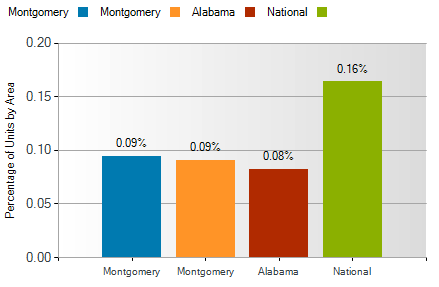

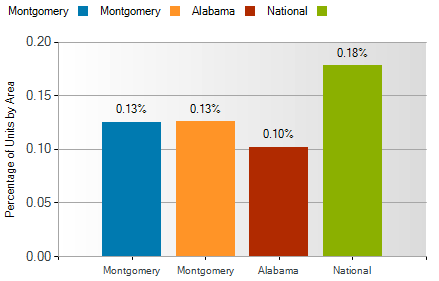

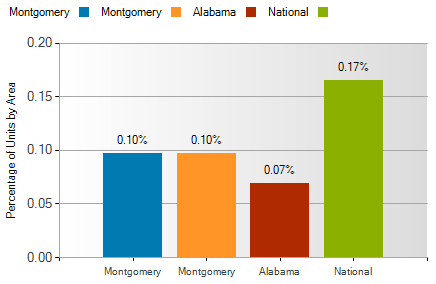

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.05% lower than national statistics. 0.03% higher than Alabama and the same as Montgomery County statistics for the month of October.

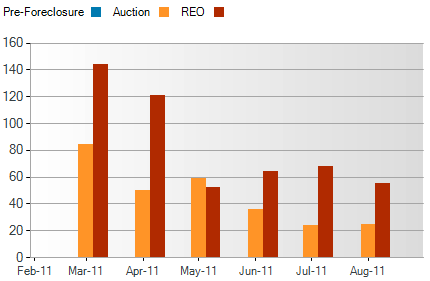

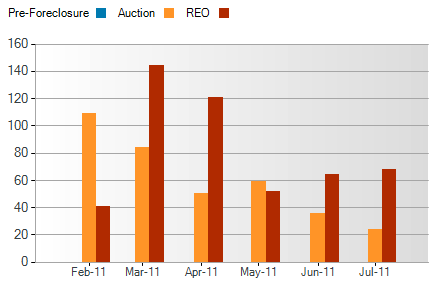

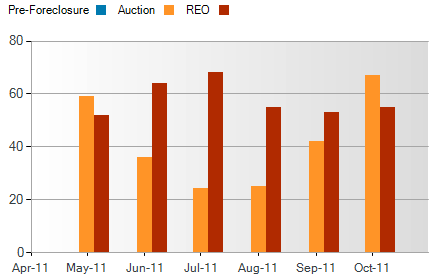

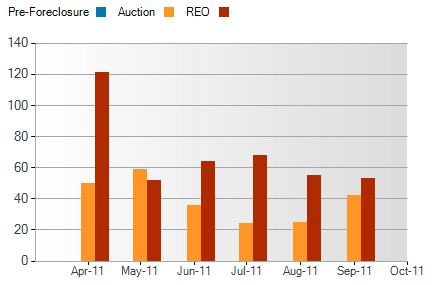

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties increased from 53 homes in September to 55 in October. The number of Auctions increased from 42 to 67. There is a 6-month rising trend.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

You can reach Sandra by filling out the online contact form below or give her a call anytime.

Thanksgiving is a time to reflect on the changes, to remember that we, too, grow and change from one season of life to another. - Author unknown

Thanksgiving is a time to reflect on the changes, to remember that we, too, grow and change from one season of life to another. - Author unknown And remember our military personnel… by contacting

And remember our military personnel… by contacting

There's a goblin at my window,

There's a goblin at my window, Ghoulish Groaners:

Ghoulish Groaners:  A kid came up with a bright idea to dress up as an IRS Agent. This way he could take 28% of the man's candy and leave without saying 'Thank You!' J)))

A kid came up with a bright idea to dress up as an IRS Agent. This way he could take 28% of the man's candy and leave without saying 'Thank You!' J)))