Montgomery AL Foreclosure Trends - January 2014

In January, the number of properties that received a foreclosure filing in Montgomery, AL was 2% lower than the previous month and 56% higher than the same time last year, according to RealtyTrac.com.

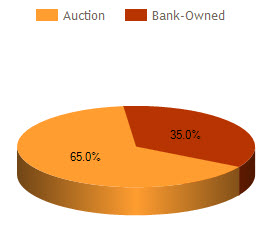

Montgomery AL Foreclosure Status Distribution

The current distribution of foreclosures based on the number of active foreclosure homes in Montgomery, AL.

Auctions accounted for 65.0% of foreclosure activity in January 2014 and Bank-owned properties accounted for 35.0%.

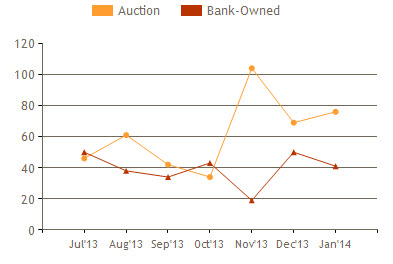

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties decreased 18.0% compared to the previous month and dropped 37.9% from the previous year in January. The number of Auctions increased 10.0% compared to the previous month and increased 744.4% from the previous year.

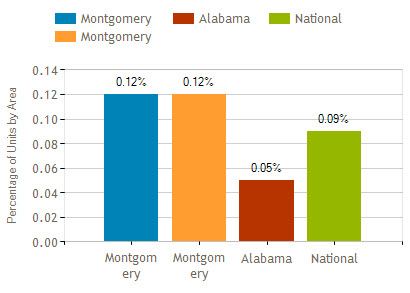

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.03% above national statistics, 0.07% higher than Alabama numbers and the same as Montgomery County statistics in January 2014.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home. Get bank-owned listings alerts FREE!

Usually, when you take money out of an individual retirement account before you reach age 59 1/2, the IRS considers these premature distributions. In addition to owing any tax that might be due on the money, you'll face a 10 percent penalty charge on the amount. This is not the case, however, when you use the money to buy your first investment property. (Note: Technically, you don't have to be purchasing your very first home or building. You qualify under the tax rules as long as you, or your spouse, didn't own a principal residence at any time during the previous two years.) You can use up to $10,000 in IRA funds toward this purchase. If you're married, and you and your spouse are both first-time buyers, you can each pull from retirement accounts, giving you $20,000 to use.

Usually, when you take money out of an individual retirement account before you reach age 59 1/2, the IRS considers these premature distributions. In addition to owing any tax that might be due on the money, you'll face a 10 percent penalty charge on the amount. This is not the case, however, when you use the money to buy your first investment property. (Note: Technically, you don't have to be purchasing your very first home or building. You qualify under the tax rules as long as you, or your spouse, didn't own a principal residence at any time during the previous two years.) You can use up to $10,000 in IRA funds toward this purchase. If you're married, and you and your spouse are both first-time buyers, you can each pull from retirement accounts, giving you $20,000 to use.