Montgomery AL Foreclosure Trends for June 2014

In June, the number of properties that received a foreclosure filing in Montgomery, AL was 57% lower than the previous month and 98% higher than the same time last year, according to RealtyTrac.com.

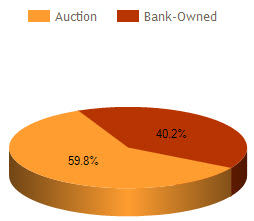

Montgomery AL Foreclosure Status Distribution

The current distribution of foreclosures based on the number of active foreclosure homes in Montgomery, AL.

Auctions accounted for 59.8% of foreclosure activity in June 2014 and Bank-owned properties accounted for 40.2%.

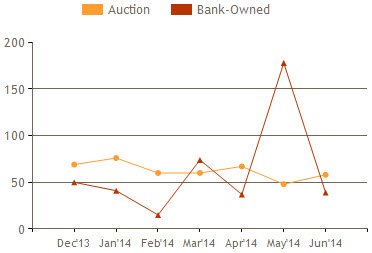

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties decreased 78.1% compared to the previous month and increased 6.0% from the previous year in June. The number of Auctions increased 20.8% compared to the previous month and 141.7% from the previous year.

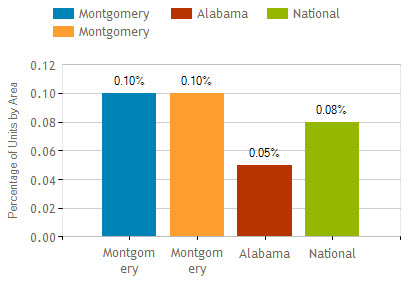

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.02% higher than national statistics, 0.05% higher than Alabama numbers and the same as Montgomery County statistics in June 2014.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home. Get bank-owned listings alerts FREE!

ense of community:

ense of community:  More money has been lost to indecision than was ever lost to making the wrong decision. The economy and the housing market have caused some people to take a “wait and see” position that could cost them in lost opportunities as well as almost certain higher costs in the future.

More money has been lost to indecision than was ever lost to making the wrong decision. The economy and the housing market have caused some people to take a “wait and see” position that could cost them in lost opportunities as well as almost certain higher costs in the future. Certainly sounds appealing--and you may be tempted to join the ranks of those who have been successful in this field. Be forewarned, however, that like most money-making endeavors, flipping requires time, money, patience and skill.

Certainly sounds appealing--and you may be tempted to join the ranks of those who have been successful in this field. Be forewarned, however, that like most money-making endeavors, flipping requires time, money, patience and skill. after all the time and effort you have put into it in previous months. Not to despair, however; it may not be too late to revive—or at least repair---the grassy areas of your landscape. Try following the following steps:

after all the time and effort you have put into it in previous months. Not to despair, however; it may not be too late to revive—or at least repair---the grassy areas of your landscape. Try following the following steps: Freddie Mac chief economist, Frank Nothaft, says that affordability, stability and flexibility are the three reasons homebuyers overwhelmingly choose a 30 year term. However, for those who can afford a higher payment, there are three additional reasons to choose a 15 year term: save interest, build equity and retire the debt sooner.

Freddie Mac chief economist, Frank Nothaft, says that affordability, stability and flexibility are the three reasons homebuyers overwhelmingly choose a 30 year term. However, for those who can afford a higher payment, there are three additional reasons to choose a 15 year term: save interest, build equity and retire the debt sooner.