Montgomery AL Foreclosure Trends for August 2014

In August, the number of properties that received a foreclosure filing in Montgomery, AL was 43% higher than the previous month and 22% lower than the same time last year, according to RealtyTrac.com.

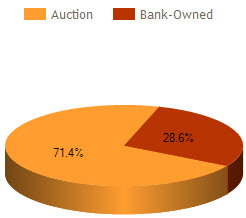

Montgomery AL Foreclosure Status Distribution

The current distribution of foreclosures based on the number of active foreclosure homes in Montgomery, AL.

Auctions accounted for 71.4% of foreclosure activity in August 2014 and Bank-owned properties accounted for 28.6%.

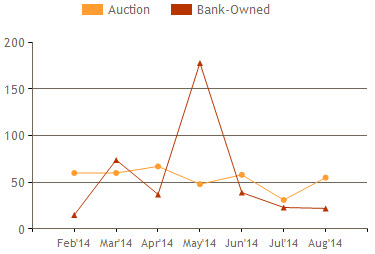

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties decreased 4.3% compared to the previous month and 42.1% from the previous year in August. The number of Auctions increased 77.4% compared to the previous month and dropped 9.8% from the previous year.

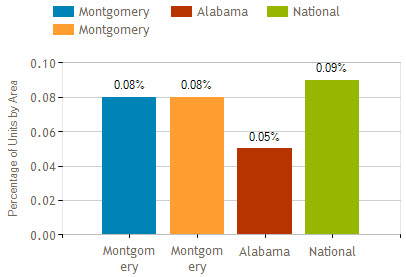

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.01% lower than national statistics, 0.03% higher than Alabama numbers and the same as Montgomery County statistics in August 2014.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home. Get bank-owned listings alerts FREE!

It had been the first piece of nice furniture that she and her husband had purchased and they had literally spent a lifetime celebrating and making decisions at that table. It troubled the owner to think that the table would go to strangers who might not appreciate it as much as her family had.

It had been the first piece of nice furniture that she and her husband had purchased and they had literally spent a lifetime celebrating and making decisions at that table. It troubled the owner to think that the table would go to strangers who might not appreciate it as much as her family had. A homeowner is “underwater” with their mortgage when they owe more than the value of their home. The term “

A homeowner is “underwater” with their mortgage when they owe more than the value of their home. The term “

Victims of Murphy’s Law can attest that their air conditioner goes out on the hottest day of the year or the water heater fails when you have out of town visitors.

Victims of Murphy’s Law can attest that their air conditioner goes out on the hottest day of the year or the water heater fails when you have out of town visitors.

1.

1.