Buyer's often find themselves watching a property for a price reduction. Although getting the best deal possible when purchasing Montgomery real estate is important, it is not the only factor that determines monthly payments on a home. Rising interest rates nearly diminish the positive aspects of waiting for prices to drop.

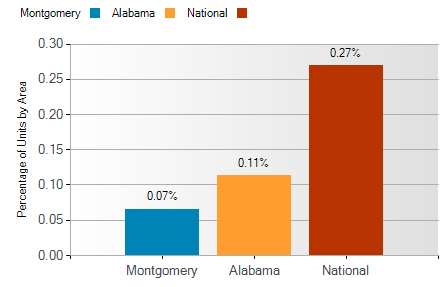

Most people are familiar with the basic trends in real estate that have been affected by the United States economic crisis. The listing prices of homes have been steadily declining over the past couple years. This has put people looking to purchase Montgomery real estate at an advantage over those trying to sell. People have best described this as a buyer's market due to the low property prices and reasonable interest rates. However, the decline in prices is stabilizing while interest rates are beginning to inch up. It is becoming more and more popular for investors to make offers on properties, sometimes sweeping the property away from home buyers. Could buyers begin loosing their advantage? Today, properties that are correctly listed at a reasonable asking price are not being reevaluated and reduced as often. These are some of the factors that prove lower Montgomery real estate prices are not always worth the wait.

Buyer's should not be waiting for interest rates to continue declining, especially since real estate and economy experts are predicting that the lowest rates have come and gone. This is not necessarily a horrible thing. Rates are still lower than historical highs, which exceed 6.00%. With the new administration trying to bring back the economy, many analysts see a period of severe inflation in our future. Meaning interest rates are likely to jump even higher. The Federal Reserve introduced a program to help control interest rates on home loans. For example, the rates for a thirty year fixed-rate loan have been consistently ranging from 4.50% to 5.00%. Now, rates for this type of loan and the rates of other types of real estate loans are beginning to exceed their more reasonable range. Therefore, increasing interest rates may start rushing your desired closing date.

At the end of May buyers, who have been procrastinating by waiting for lower interest rates or price reductions, learned their lesson the hard way. At the end of the month interest rates went up about .50%-1.00%. Increasing interest rates defeats the purpose of waiting for [city] real estate prices to drop. Higher interest rates decrease the overall affordability and increase the monthly payments, especially when the price of the desired home does not budge.

Bottom line, it is not a time to be waiting around. Time is running out to take advantage of the current real estate market and loan programs being offered by the government. For instance, first time home buyers have until December 1st, 2009 to close on their home if they want to be eligible for a maximum tax rebate of $8,000 dollars. Since interest rates are expected to increase, waiting for real estate prices to drop is not worth the wait. Don't procrastinate. You might unintentionally pass up a piece of gold trying to find a diamond.

Search all Montgomery real estate and homes for sale by visiting HatTeam.com.