In October, the number of properties that received a foreclosure filing in Montgomery, AL was 16% higher than the previous month and 5% higher than the same time last year, according to RealtyTrac.com.

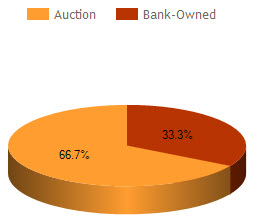

Montgomery AL Foreclosure Status Distribution

The current distribution of foreclosures based on the number of active foreclosure homes in Montgomery, AL.

Auctions accounted for 66.7% of foreclosure activity in October 2014 and Bank-owned properties accounted for 33.3%.

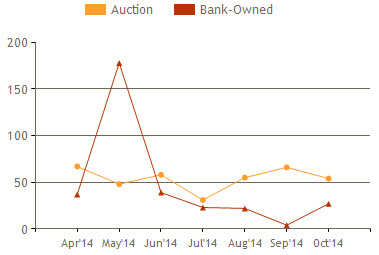

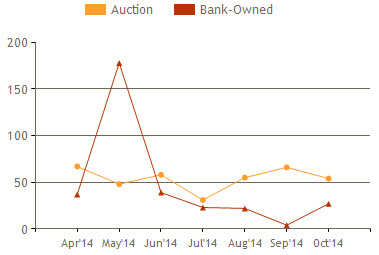

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties increased 575.0% compared to the previous month and decreased 37.2% from the previous year in October. The number of Auctions decreased 18.2% compared to the previous month and increased 58.8% from the previous year.

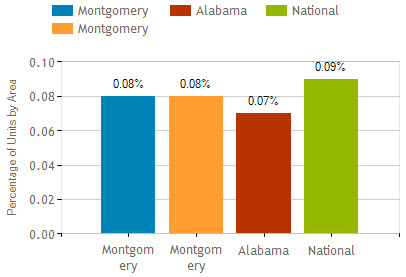

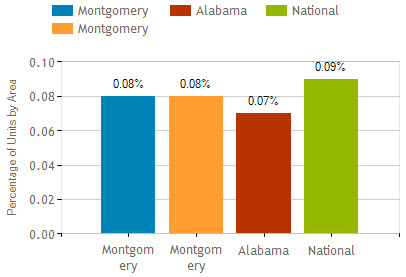

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.01% lower than national statistics, 0.01% higher than Alabama numbers and the same as Montgomery County statistics in October 2014.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home. Get bank-owned listings alerts FREE!

Decorate your home like you have never decorated it before to make it stand out above all the other homes that are for sale during the holiday season. You may not feel like doing this because you are most likely ready to move out and get on with your life, but if you take the time to make your home look beautiful for the holidays, it is most likely going to get the attention of several buyers that might not otherwise take a second look at your home. Be sure to have a few showings during the evenings if your Realtor will agree so that you can show off your awesome light display.

Decorate your home like you have never decorated it before to make it stand out above all the other homes that are for sale during the holiday season. You may not feel like doing this because you are most likely ready to move out and get on with your life, but if you take the time to make your home look beautiful for the holidays, it is most likely going to get the attention of several buyers that might not otherwise take a second look at your home. Be sure to have a few showings during the evenings if your Realtor will agree so that you can show off your awesome light display. In some cases, you might only be able to name one or two of your neighbors who would step up to that level of service. Wouldn’t it be nice if more people on your street would be happy to make that offer?

In some cases, you might only be able to name one or two of your neighbors who would step up to that level of service. Wouldn’t it be nice if more people on your street would be happy to make that offer? before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to

before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to

After all, your monthly payment includes 1/12 the annual amount so there will be money available for them to be paid on time.

After all, your monthly payment includes 1/12 the annual amount so there will be money available for them to be paid on time. A low inventory of properties also tends to cause bidding wars to come back. That means homebuyers have to get more creative. Paul Bishop, VP of NAR suggests going beyond the usual market tactics to help you be the first to find homes. Simply getting pre-qualified for a mortgage is not enough anymore.

A low inventory of properties also tends to cause bidding wars to come back. That means homebuyers have to get more creative. Paul Bishop, VP of NAR suggests going beyond the usual market tactics to help you be the first to find homes. Simply getting pre-qualified for a mortgage is not enough anymore.