Montgomery AL Foreclosure Trends - Dec 2011

There were 873 Montgomery AL foreclosure homes for sale with 1 in every 1,675 housing units receiving a foreclosure filing in December 2011. The average selling price of a Montgomery AL home was $108,647 and the average foreclosure selling price was $72,743, a $35,905 savings, according to RealtyTrac.com.

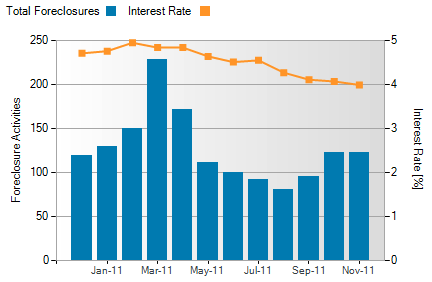

Montgomery AL Foreclosure Activity and 30 Year Interest Rate

Montgomery interest rates averaged 3.96% in December while the number of foreclosed homes dropped from 122 to 58.

.png)

Foreclosure activity is based on the total number of properties that receive foreclosure filings – default notice, foreclosure auction notice or bank repossession – each month. Interest rate is based on the average 30-year fixed rate from Freddie Mac Primary Mortgage Market Survey.

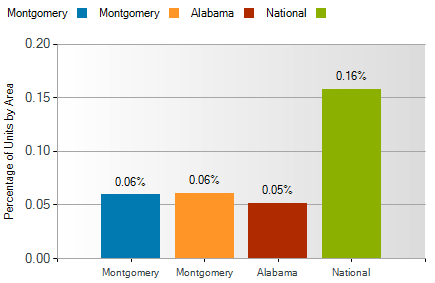

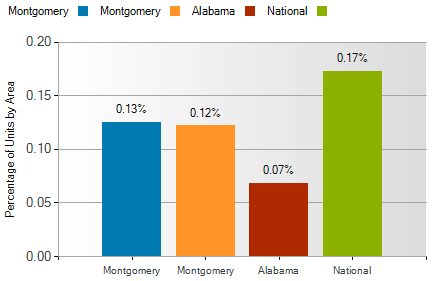

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.10% lower than national statistics, 0.01% higher than Alabama and the same as Montgomery County statistics for the month of December.

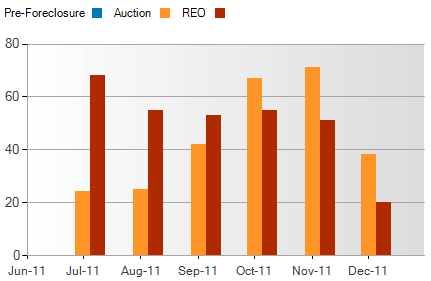

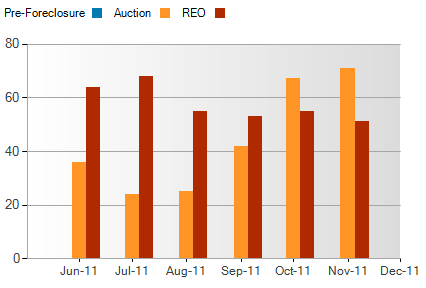

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties decreased from 51 homes in November to 20 in December. The number of Auctions dropped from 71 to 38. There is a 6-month rising trend.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

You can reach Sandra by filling out the online contact form below or give her a call anytime.

.jpg)

If you are one of the millions of Americans whose home has lost value in recent years, despair not. Whether you’re trying to spiff up your

If you are one of the millions of Americans whose home has lost value in recent years, despair not. Whether you’re trying to spiff up your

Montgomery AL home. As American lifestyles change, so do

Montgomery AL home. As American lifestyles change, so do .jpg)

Not only do many folks have vacation time in December and are thus free to house shop, but the slower months are often the ones where buyers are really serious and prices have been reduced.

Not only do many folks have vacation time in December and are thus free to house shop, but the slower months are often the ones where buyers are really serious and prices have been reduced.