Tips For Improving Your Score

Your credit score is a number that helps lenders predict how likely you are to make your payments on time. This score affects your ability to obtain credit and helps determine what you pay for credit cards, auto loans, and mortgages on Montgomery AL homes. Even your insurance rate is related to your score. The higher your score, often referred to as a FICO score, the more apt you are to be approved for and pay a lower interest rate on new loans. Scores ranging from 650 and below are considered bad and indicate to the lender that you are a very high risk. Chances are you will be unable to secure a loan, or if you are, it will be at a much higher interest rate and/or require a cosigner.

What If there Are Errors

What to do if you have a low score and do not qualify for a mortgage on a Montgomery AL home? Your first action should be to check your credit report for errors. If you find erroneous information, you need to act immediately by contacting both the credit bureau (the three major ones are Equifax, Experian, and Transunion) and the organization that provided that information.

- The credit bureau/agency: Send a certified, return receipt requested letter to the bureau pointing out each inaccuracy and enclose copies of documents which support your claim as well as the report itself (with the misinformation highlighted). Factually explain why you dispute each item and request a deletion or correction for each one.

- The creditor or information provider: Send the same type of letter and enclose the same documents. Request that the provider notify you of action taken (generally within 90 days) so that you can verify the amended information.

If there are no errors on your report, then you should take immediate steps to improve your credit. Ways to do this include the following:

- Stop using your credit cards. Do not continue to accumulate debt.

- Get current on delinquent accounts. Since payment history makes up 35% of your score, this action will have a great impact on your score.

- Keep accounts with balances open, but don’t apply for more credit.

- Call your creditors. Explain your financial situation and ask about possible hardship programs which will temporarily reduce your monthly payments.

- Begin paying off your existing debts, even if you have to sell some belongings to do so. Come up with a get-out-of-debt plan and stick to it.

- Get professional help. There are resources available to help you reestablish a good credit rating. Contact the National Foundation for Credit Counseling for assistance.

7. Be patient. Realize that improving your credit score takes time and that there is no quick-fix --and keep in mind your goal of owning a Montgomery AL home.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

You can reach Sandra by filling out the online contact form below or give her a call anytime.

TIME AND PLACE:

TIME AND PLACE: . Is the square footage correct? What about the number of bedrooms or bathrooms? Have any recent improvements you’ve made to the property been included? If not, appeal the appraisal.

. Is the square footage correct? What about the number of bedrooms or bathrooms? Have any recent improvements you’ve made to the property been included? If not, appeal the appraisal.

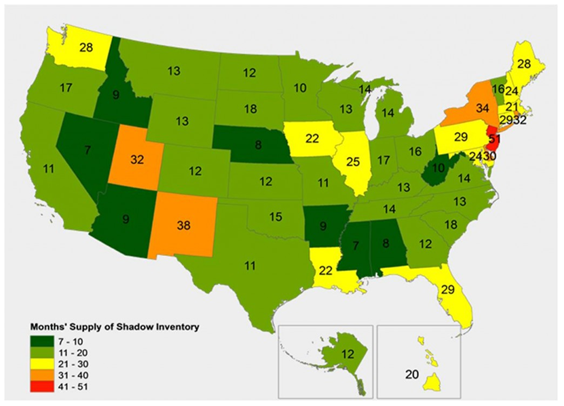

What do the numbers mean?

What do the numbers mean? , however, you should determine if he/she is qualified to handle your

, however, you should determine if he/she is qualified to handle your