Enjoy Your Improvements and Profit by Them

Homeowners can raise the basis or cost in their home by money spent on capital improvements. The benefit is that it will lower their gain and may save them taxes when they sell their home.

Improvements must add value to your home, prolong its useful life or adapt it to new uses. Repairs are routine in nature to maintain the value and keep the property in an ordinary, operating condition.

Improvements must add value to your home, prolong its useful life or adapt it to new uses. Repairs are routine in nature to maintain the value and keep the property in an ordinary, operating condition.

Additions of decks, pools, fences and landscaping add value to a home as well as new floor covering, counter-tops and other updates. Replacing a roof, appliances or heating and cooling systems would be considered to extend the useful life of the home. Completing an unfinished basement or converting a garage to living space are common examples of adapting a portion of the home to a new use.

Other items that can raise the basis in your home are special assessments for local improvements like sidewalks or curbs and money spent to restore damage from casualty losses not covered by insurance.

Here’s a simple idea that could save you money years from now.

Every time you spend money on your home other than the house payment and the utilities, put the receipt or canceled check in an envelope labeled “Home Improvements.” Regardless of whether you know if the money would be classified as maintenance or improvements, the receipt or cancelled check goes in the envelope.

Years from now, when you’ve sold your home and you need to report the gain on the property, you or your accountant can go through the envelope and determine which of the expenditures will be adjustments to your basis.

Some people disregard this idea because of the generous exclusion allowed on principal residences. At the unknown point in the future when you sell your home, circumstances may have changed and the proof of these expenditures will be valuable. The tax laws could lower the exclusion amount or eliminate it altogether. Your marital status may change because of death or divorce. The market value of your home may skyrocket.

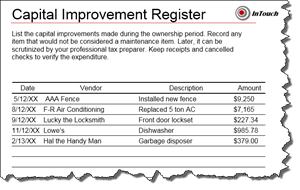

Since the future is unknown, it is better to keep track of the improvements as they are made and how much is spent on them. Download an Improvement Register and examples or read more in Publication 523 on Increases to Basis.

Information courtesy of Montgomery AL Realtor Sandra Nickel, Sandra Nickel Hat Team.

information behind that others can use---mail that is not rerouted to our new address, important papers that aren't shredded but left in the trash, or through hiring rogue movers. The

information behind that others can use---mail that is not rerouted to our new address, important papers that aren't shredded but left in the trash, or through hiring rogue movers. The  affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home?

affected, it is only natural that we ask ourselves,” Would I be able to sustain such losses? Would my homeowners insurance policy cover the costs of rebuilding my home? Victims of Murphy’s Law can attest that their air conditioner goes out on the hottest day of the year or the water heater fails when you have out of town visitors.

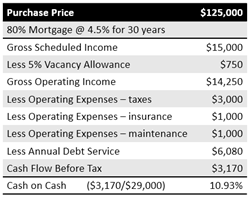

Victims of Murphy’s Law can attest that their air conditioner goes out on the hottest day of the year or the water heater fails when you have out of town visitors. Years ago, real estate investors used to accept negative cash flow buoyed by tax incentives in hopes of making a big payday due to appreciation when they sold it. Today’s investors are focusing on tangible, current results like cash flow and equity build-up.

Years ago, real estate investors used to accept negative cash flow buoyed by tax incentives in hopes of making a big payday due to appreciation when they sold it. Today’s investors are focusing on tangible, current results like cash flow and equity build-up. How old is your bedroom furniture and what did you pay for it? Don’t know? That’s okay, let’s try an easier question. When did you buy the TV in your family room and is it a plasma, LCD or a LED?

How old is your bedroom furniture and what did you pay for it? Don’t know? That’s okay, let’s try an easier question. When did you buy the TV in your family room and is it a plasma, LCD or a LED? Interior updates:

Interior updates: The first assumption that has to be made is that the comparable homes are similar in size, location, condition and amenities. Obviously, a variance in any of these things affects the price per square foot which will not give you a fair comparison.

The first assumption that has to be made is that the comparable homes are similar in size, location, condition and amenities. Obviously, a variance in any of these things affects the price per square foot which will not give you a fair comparison.

ense of community:

ense of community: