Montgomery Foreclosure Statistics - February 2010

There are 1,397 Montgomery foreclosure homes for sale with 175 new foreclosures in February 2010. The average selling price of a Montgomery home is $171,767 and the average foreclosure selling price is $124,967, a $46,799 savings, according to RealtyTrac.com.

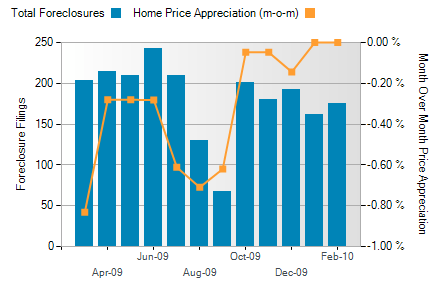

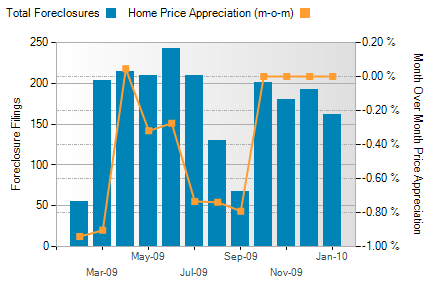

Montgomery Foreclosure Activity and Home Price Index

Home price appreciation remained the steady in February while the number of new Montgomery foreclosure homes dropped to 175.

Montgomery foreclosure activity is based on the total number of properties that receive foreclosure filings - default notice, foreclosure auction notice or repossession notice - each month. Home price appreciation is based on month-over-month percentage change of the Home Price Index. The Home Price Index is calculated from home sales records.

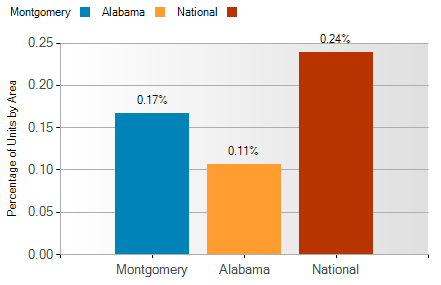

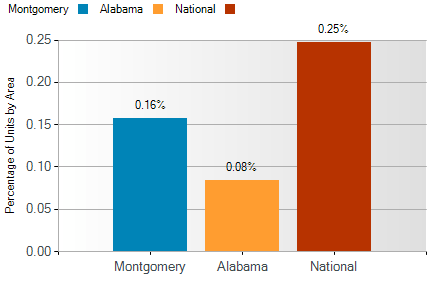

Montgomery Foreclosure Geographical Comparison

Montgomery foreclosure activity is 0.07% lower than national statistics and 0.06% higher than Alabama statistics.

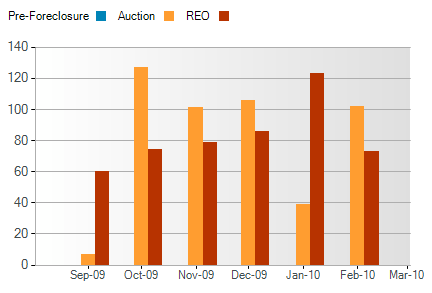

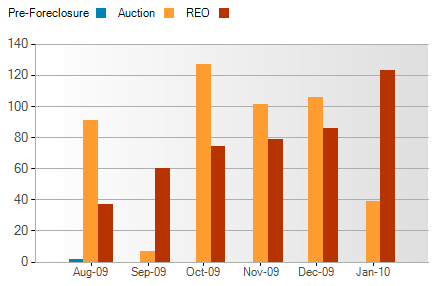

Montgomery Foreclosure Activity by Month

The number of Bank-Owned properties dropped from 123 homes in January to 73 in February. The number of Auctions rose from 39 to 102. The 6-month trend reflects a rise in Montgomery foreclosures.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Myth: Checking a credit report can either damage or lower your score.

Myth: Checking a credit report can either damage or lower your score.

wonder or worry about selling their home for the best price, and terms in the shortest period of time.

wonder or worry about selling their home for the best price, and terms in the shortest period of time.  Tax Credit for First-Time Home buyers

Tax Credit for First-Time Home buyers