Montgomery AL Foreclosure Trends - June 2013

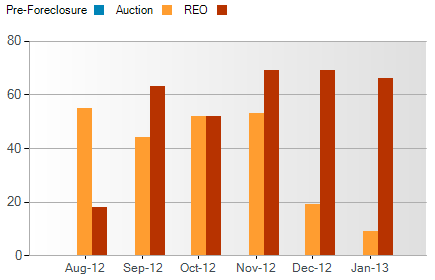

In June, the number of properties that received a foreclosure filing in Montgomery, AL was 66% lower than the previous month and 54% lower than the same time last year, according to RealtyTrac.com.

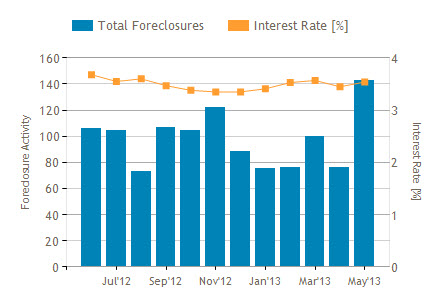

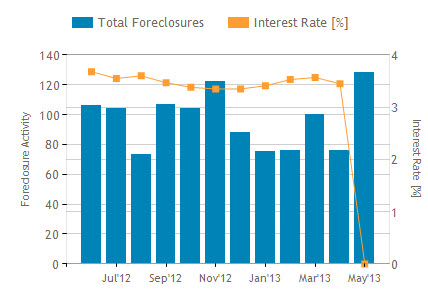

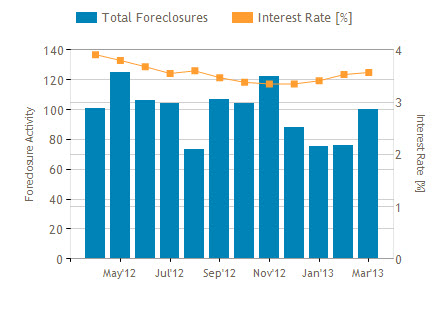

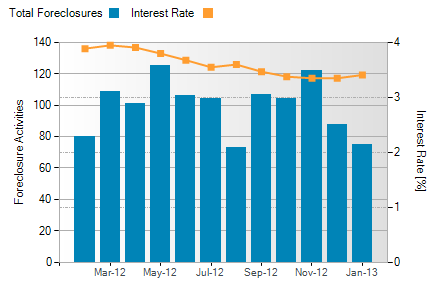

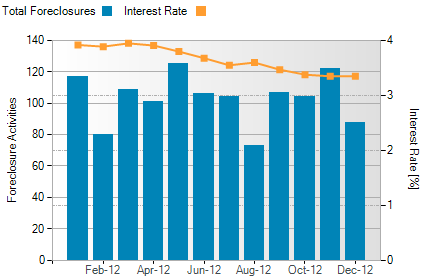

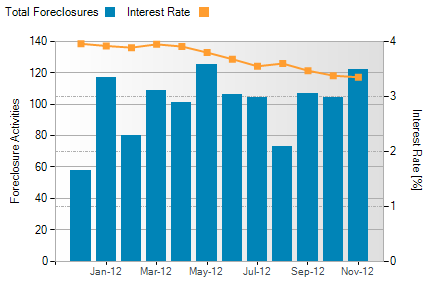

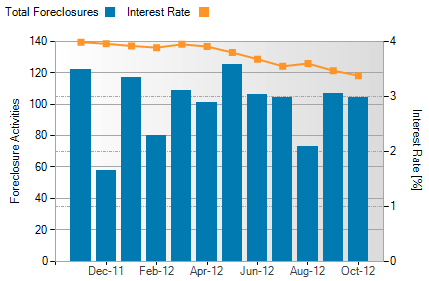

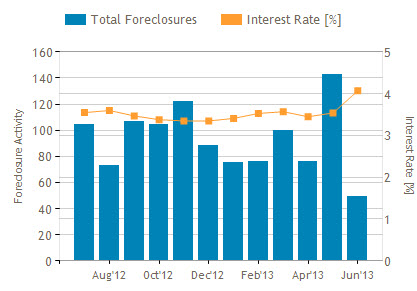

Montgomery AL Foreclosure Activity and 30 Year Interest Rate

Foreclosure activity is based on the total number of properties that receive foreclosure filings – default notice, foreclosure auction notice or bank repossession – each month. Interest rate is based on the average 30-year fixed rate from Freddie Mac Primary Mortgage Market Survey.

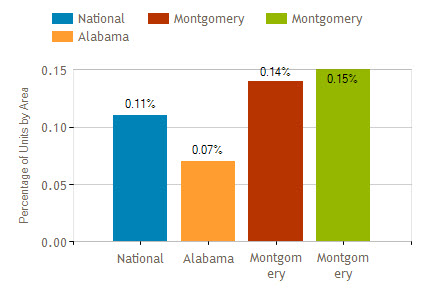

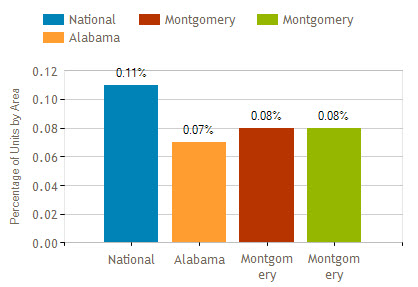

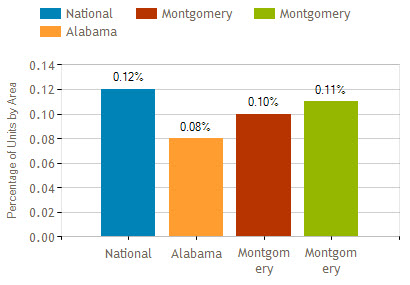

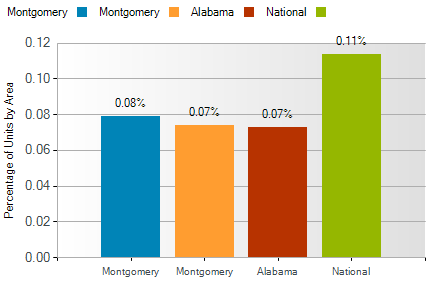

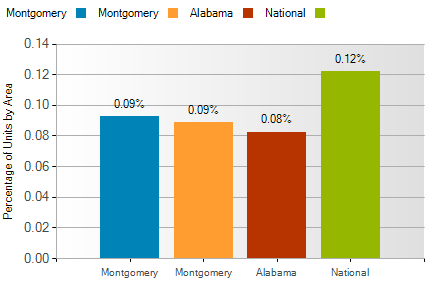

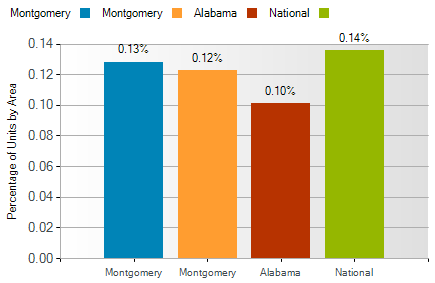

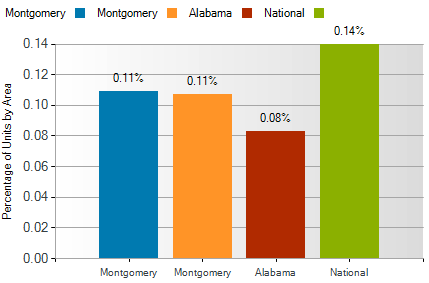

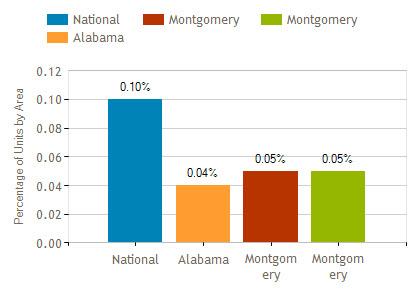

Montgomery AL Foreclosure Geographical Comparison

Montgomery AL foreclosure activity was 0.05% lower than national statistics, 0.01% higher than Alabama and the same as Montgomery County statistics in June 2013.

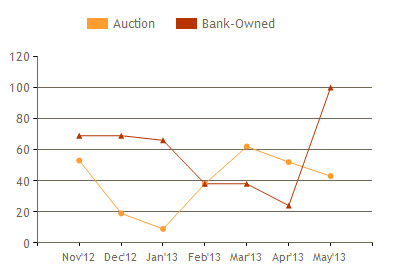

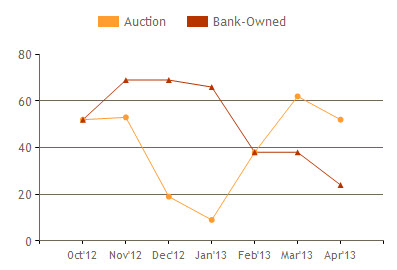

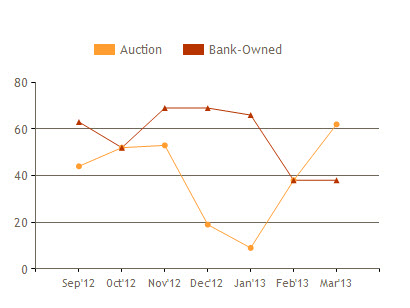

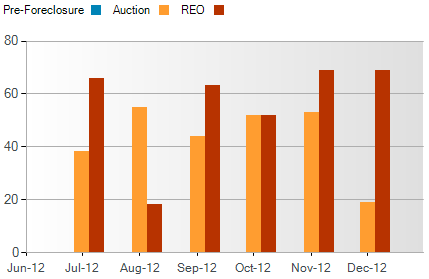

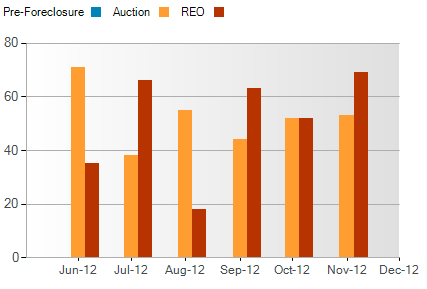

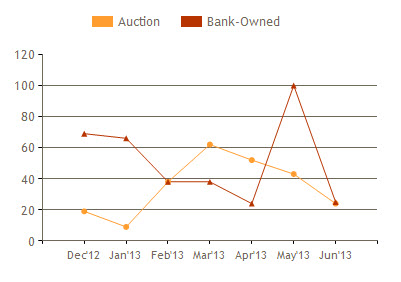

Montgomery AL Foreclosure Activity by Month

The number of Bank-Owned properties declines 75.0% compared to May and decreased 28.6% compared to June 2012. The number of Auctions decreased 44.2% compared to May and 66.2% from June 2012.

Are you or someone you know behind on mortgage payments and facing a Montgomery foreclosure? You do have options. A short sale may be the answer to saving you, your family and your home. I am a Certified Distressed Property Expert (CDPE) with specialized training in helping families avoid foreclosure. Give me a call for a private consultation.

Search all Montgomery AL Real Estate And Homes For Sale.

Sandra Nickel and the Hat Team have distinguished themselves as leaders in the Montgomery AL real estate market. Sandra assists buyers looking for Montgomery real estate for sale and aggressively markets Montgomery AL homes for sale. Sandra is also an expert in helping families avoid foreclosure through short sales and is committed to helping families in financial hardship find options. For more information you can visit AvoidForeclosureMontgomery.com.

Interested in buying a bank-owned home. Get bank-owned listings alerts FREE!

You can reach Sandra by filling out the online contact form below or give her a call anytime.

The federal government has six programs, some older, some recently revised, and one brand new, specifically for those in jeopardy of losing their homes. Listed below are the “barebones” of each one and some sites at which to garner further information:

The federal government has six programs, some older, some recently revised, and one brand new, specifically for those in jeopardy of losing their homes. Listed below are the “barebones” of each one and some sites at which to garner further information: