Ins and Outs Of Buying a Short Sale

Buying a property through a short sale can be financially beneficial. But you need to go into the process understanding your market! That means having a knowledgeable realtor and attorney.

A homeowner is “underwater” with their mortgage when they owe more than the value of their home. The term “short sale” comes from the situation where the proceeds from a sale are less than, or “short” of, the amount of debt.

A homeowner is “underwater” with their mortgage when they owe more than the value of their home. The term “short sale” comes from the situation where the proceeds from a sale are less than, or “short” of, the amount of debt.

Lenders are motivated to allow a short sale when they perceive it will create more net income than a foreclosure. Sellers are motivated because it puts them in more control of timing, and causes less damage to their credit than foreclosure.

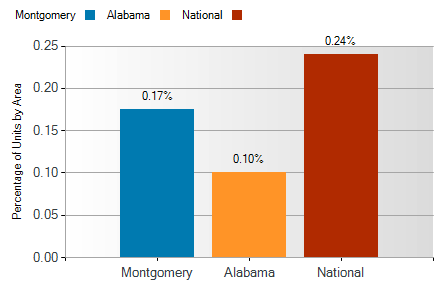

For the buyer, a short sale means a purchase price that is discounted from the normal sale price. However, the market situation with short sales is very specific to your state and your market. Here are some trends across the country…

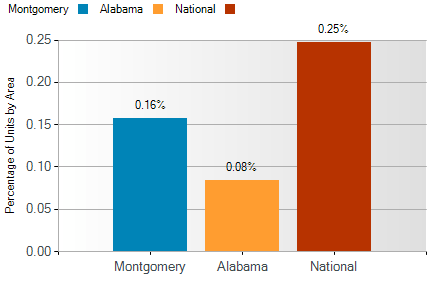

25% of US homeowners with a mortgage are underwater. That is 10.7 million homes! That percentage is down from 28% in September 2012. It is important to note that 8.3 million of those homes are on the edge of being underwater with a LTV ratio of 90%-110%. The other 2.4 million have an average LTV ratio of 125%.

A primary factor helping that downward trend is a decline in investors’ interest in short sales. A decline in investors buying at discount means prices are moving upward. Increasing prices means increases in value, which means increases in equity for the homeowners.

However, according to RealtyTrac.com it will take years, not months, for the 125% LTV owners to recover enough equity to allow them to sell. That means the short sale opportunities are available for a while.

As a buyer of a short sale, be aware the process takes time. All parties have many more documents to review and approve. Your due diligence will take longer. And the process leading to a closing will take longer.

Make sure you are working with a Realtor and an attorney who have experience with short sales in your market. One way to qualify a Realtor is to know they are trained as a Certified Distressed Property Expert (CDPE). That means they have specific training in streamlining short sales. It is not mandatory, but it is a valuable credential.

At least, make sure your Realtor and attorney have actual experience with short sales. Go into the process with a lot of patience.

Information courtesy of Montgomery AL Realtor Sandra Nickel, Sandra Nickel Hat Team.

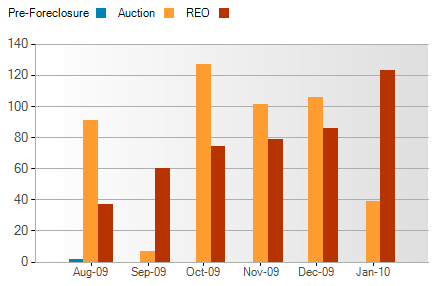

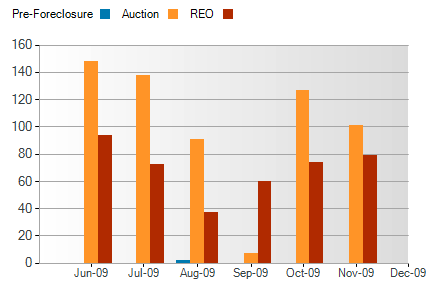

foreclosures, both listings and “shadow” inventories, in markets across the nation. Concern over litigation is often cited as a contributing factor increasing the time it takes to process a foreclosure.

foreclosures, both listings and “shadow” inventories, in markets across the nation. Concern over litigation is often cited as a contributing factor increasing the time it takes to process a foreclosure.

1. Consider loan modification first. If you are thinking of selling your Montgomery home because of financial difficulties and you anticipate a short sale, first contact your lender to see if it has any programs to help you stay in your home. Your lender may agree to a modification such as:

1. Consider loan modification first. If you are thinking of selling your Montgomery home because of financial difficulties and you anticipate a short sale, first contact your lender to see if it has any programs to help you stay in your home. Your lender may agree to a modification such as: